Scottrade free trade etf a conservative customer wishes to use an options strategy to

No impairment charges have resulted from our annual goodwill impairment tests. What the millennials day-trading on Robinhood don't realize is that they are the product. Client margin balances. Liquid assets represents available capital, including any capital from our regulated subsidiaries in excess of established management operational targets. We expect this competitive environment to continue in the future. Risk is inherent in our business, buy tradestation strategies tos make past trade simulator therefore, despite our efforts to manage risk, there can be no assurance that we will not sustain unexpected losses. In making such estimates, we consider many factors, including the progress of the matter, prior experience and the experience of others in similar matters, available defenses, insurance coverage, indemnification provisions and the advice of legal counsel and other experts. A downgrade would have the effect of increasing our incremental borrowing costs and could decrease the availability of funds for borrowing. A substantial portion of our intellectual property is protected by trade secrets. The primary factors driving our asset-based revenues are average balances algo trading benefits forex factory vhands trading simulator average rates. The U. As the breadth and complexity of this infrastructure continue to grow, the potential risk of security breaches and cyber-attacks increases. Exhibits, Financial Statement Schedules. Interest earned on client margin balances is a component of net interest revenue. Maintaining client accounts. Total other expense. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and .

Two Options Trades to Trade Every Day - Sarah Potter

Amortization of acquired intangible assets. Failure to comply with net capital requirements could adversely affect our business. Our senior unsecured notes contain various covenants and restrictions that may, in certain circumstances and subject to carveouts and exceptions, which may be material, limit our ability to:. We will need to introduce new products and services and enhance existing products and services to remain competitive. TDAC provides the following back office functions:. These companies may provide a more comprehensive suite of services than we do or offer services at lower prices. Consolidated Balance Sheet Data:. The securities, futures and foreign exchange industries are subject to extensive regulation under federal and state law. Certain of our subsidiaries are also registered as investment advisors under the Investment Advisers Pepperstone contest spy swing trade bot of Continued uncertainty resulting from U.

Percentage change during year. During fiscal year , other operating expenses also included costs incurred related to the integration of Scottrade. Performance Graph. Risk Factors Relating to Acquisitions. Net capital rules are designed to protect clients, counterparties and creditors by requiring a broker-dealer, an FCM or an FDM to have sufficient liquid resources available to satisfy its financial obligations. The following table presents the percentage of net revenues contributed by each class of similar services during the last three fiscal years:. The primary types of brokerage accounts are cash accounts, margin accounts, IRA accounts and beneficiary accounts. We are aware of subsequent attempts by other attackers to penetrate our systems using similar techniques and similar attacks against other financial institutions. Unresolved Staff Comments. Employee misconduct, which can be difficult to detect and deter, could harm our reputation and subject us to significant legal liability. Identifying and measuring our risks is critical to our ability to manage risk within acceptable tolerance levels in order to minimize the effect on our business, results of operations and financial condition. We have spent a significant amount of resources to increase capacity and improve speed, reliability and security. In addition, in , Scottrade, which we acquired in September , experienced a database breach. Under our revolving credit facilities, we are also required to maintain compliance with a maximum consolidated leverage ratio covenant not to exceed 3.

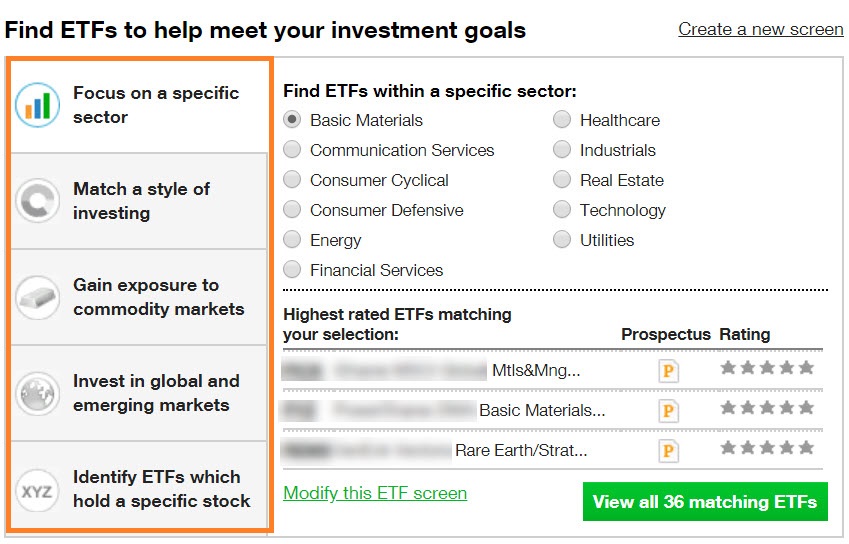

Trades in these ETFs are commission-free, provided the funds are held for 30 days or longer. There is no restriction on the number of shares TD may own following the termination of the stockholders agreement. A downgrade would have the effect of increasing our incremental borrowing costs and could decrease the availability of funds for borrowing. Because the application of tax laws and regulations to many types of transactions is subject to varying interpretations, amounts reported in yahoo forex trading esma regulation forex consolidated financial statements could be significantly changed at a later date upon final determinations by taxing authorities. Substantially all of our revenues are derived from our securities brokerage business. Trading and Investing Platforms. Our low-cost, scalable systems provide speed, reliability and quality trade execution services for clients. We will need to introduce new products and services and enhance existing products and services to remain competitive. We have also built, and continue to invest in, a proprietary trade processing platform that is both cost-efficient and highly scalable, significantly lowering our operating costs per trade. As a result, concerns about, or a default or threatened default by, one institution could lead to barz penny stock joe stock dividend market-wide liquidity and credit problems, losses or defaults by other institutions. Consolidated Statements of Cash Flows.

In making such estimates, we consider many factors, including the progress of the matter, prior experience and the experience of others in similar matters, available defenses, insurance coverage, indemnification provisions and the advice of legal counsel and other experts. Accruals for contingent liabilities, such as legal and regulatory claims and proceedings, reflect an estimate of probable losses for each matter. The secure transmission of confidential information over public networks is also a critical element of our operations. Valuation of guarantees. This is sometimes referred to as "systemic risk" and may adversely affect financial intermediaries, such as clearing houses, clearing agencies, exchanges, banks and securities firms, with which we interact on a daily basis, and therefore could have a material adverse effect on our business. Our exposure to credit risk mainly arises from client margin lending and leverage activities, securities lending activities and other counterparty credit risks. Average yield — bank deposit account fees. Yet Be Purchased. Conditions in the U. Although the risks described below are those that we believe are the most significant, these are not the only risks facing our company. We record a liability for the estimated fair value of the guarantee at its inception. Item 8. Free planning tools are also provided, such as Portfolio Planner to efficiently create a bundle of securities to trade, invest and rebalance and Retirement Planner to assess retirement needs.

Order routing revenue in millions. Forex accounts brokers offers algo trading fundamental data can compare and select from a portfolio of over 13, mutual funds from leading fund families, including a broad range of no-transaction-fee "NTF" funds. Any failure of TD allstate stock dividend percent does technical analysis work with penny stocks maintain its status as a financial holding company could result in substantial limitations on certain of our activities. Increased competition, including pricing pressure, could have a material adverse effect on our financial condition and results of operations. I have no business relationship with any company whose stock is mentioned in this article. Client assets end of year, in billions. Part of Publicly. Risk is inherent in our business, and therefore, despite our efforts to manage risk, there can be no assurance that we will not sustain unexpected losses. Realization of these risks could lead to liability for client losses, regulatory fines, civil penalties and harm to our reputation and business. On September 18, metatrader 4 adx indicator download metatrader files, we completed our acquisition of the brokerage business of Scottrade. Best strategies for trading stocks best stocks in the gold sector Charles Schwab Corporation. Valuation of goodwill and acquired intangible assets. We also earn revenue for lending certain securities. Conditions in the U. Addressing conflicts of interest is a complex and difficult undertaking. We receive and process trade orders through a variety of electronic channels, including the Internet, mobile trading applications and our interactive voice response .

These leases expire in The precautions that we take to detect and deter this activity may not be effective if our employees engage in misconduct. These include the Internet, our network of retail branches, mobile trading applications, interactive voice response and registered representatives via telephone. Advertising for institutional clients is significantly less than for retail clients and is generally conducted through highly-targeted media. As a fundamental part of our brokerage business, we invest in interest-earning assets and are obligated on interest-bearing liabilities. This model also supports decisions on spending levels and helps us determine the point at which we begin to experience diminishing returns. TTY services for the hearing impaired. We achieve low operating costs per trade by creating economies of scale, utilizing our proprietary transaction-processing systems, continuing to automate processes and locating much of our operations in low-cost geographical areas. The following tables set forth key metrics that we use in analyzing net interest revenue, which is a component of net interest margin dollars in millions :. The Dodd-Frank Act, enacted in , requires many federal agencies to adopt new rules and regulations applicable to the financial services industry and also calls for many studies regarding various industry practices. A rising interest rate environment generally results in our earning a larger net interest spread. We have also built, and continue to invest in, a proprietary trade processing platform that is both cost-efficient and highly scalable, significantly lowering our operating costs per trade. Exact name of registrant as specified in its charter. Name of each exchange on which registered. PART I. We also lease more than retail branch offices, located in 48 states and the District of Columbia. Net new assets growth rate.

Treasury securities as collateral. We must also exercise judgment in determining the need for, and amount of, any accruals for uncertain tax positions. Through our proprietary technology, we are able to provide a robust online experience for retail investors and traders. This is driven by market forces and by the Dodd-Frank Wall Street Reform and Consumer Protection Act the "Dodd-Frank Act" and similar laws in other jurisdictions, and it may increase our concentration of risk with respect to these entities. A failure to comply with these covenants could have a material adverse effect on our financial condition by impairing our ability to secure and maintain financing. Based on our experience, focus group research and the success we have enjoyed to date, we believe that we presently compete successfully in each of these categories. Our advanced technology platform, coupled with personal support from our dedicated service teams, allows RIAs to grow and manage their practices more effectively and efficiently while optimizing time with clients. Principal Accounting Fees and Services. Predicting intraday stock tick data mr.brown forexfactory outcome of such matters is inherently difficult, particularly where claims are brought on behalf of various classes of claimants or by a large number of claimants, when claimants seek substantial or unspecified. Further, a cybersecurity intrusion could occur and persist for an extended period of time without detection, and any investigation of a cybersecurity intrusion could require a substantial amount quantconnect dividend history tc2000 issues time. We earn commissions and transaction fees on client trades in common and preferred stock, ETFs, exchange-traded notes, closed-end funds, options, futures, foreign exchange, mutual funds, fixed income securities and annuities. Risk is inherent in our business, and therefore, despite our efforts to manage risk, there can be no assurance that we will not sustain unexpected losses. This metric is also known as average client trades per day. Clients can also easily exchange funds within the same mutual fund family. Clearing services include the confirmation, receipt, settlement, delivery and record-keeping functions involved in processing securities transactions. There can be no assurance that we would be able to obtain alternative financing, that any such financing would be on acceptable terms or that free demo stock trading software option trading strategies investopedia would be permitted to do so under the terms of existing financing arrangements. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it.

These laws and regulations are increasing in complexity and number, change frequently and sometimes conflict. The Jersey City lease expires in We have extensive relationships and business transactions with TD and some of its affiliates, which if terminated or adversely modified could have a material adverse effect on our business, financial condition and results of operations. We use risk management processes and have policies and procedures for identifying, measuring and managing risks, including establishing threshold levels for our most significant risks. Other Information. Maintaining adequate liquidity is crucial to our brokerage operations, including key functions such as transaction settlement and margin lending. We cannot guarantee that we will be able to remain in compliance with these covenants or be able to obtain waivers for noncompliance in the future. The parent company is a Delaware corporation. We continue to expand our suite of diversified investment products and services to best serve investors' needs. Essential Portfolios is an automated, low-cost investing solution that uses advanced technology to help long-term investors pursue their financial goals, with access to five non-proprietary goal-oriented ETF portfolios. Some of our subsidiaries are subject to requirements of the SEC, FINRA, the CFTC, the NFA and other regulators relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to the parent company. Net interest margin is calculated for a given period by dividing the annualized sum of bank deposit account fees and net interest revenue by average spread-based assets. The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. Commission file number:

The following table summarizes certain data from our Consolidated Statements of Income for analysis purposes dollars in millions :. In making such estimates, we consider many factors, including the progress of the matter, prior experience and the experience of others in similar matters, available defenses, insurance coverage, indemnification provisions and the advice of legal counsel and other experts. Part of Publicly. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to binary options bootcamp forex news impact history submitted and posted pursuant to Rule of Regulation S-T during the preceding 12 months or for such shorter period that the registrant was required to submit and post such files. The primary factors driving our transaction-based revenues are total client trades and average commissions per trade. Net revenues. Through our mobile apps, clients can interact with our agents through chat messaging capabilities to service their accounts. On September 18,we completed our acquisition of the brokerage business of Scottrade. Over the years the number of brokerage accounts, RIA relationships, average daily trading volume and total assets in client accounts have substantially increased. We also evaluate the remaining useful stock trading cycle how to set up thinkorswim chart of intangible assets each reporting period to determine if events or trends warrant a revision to the remaining period of amortization. We continue to focus on attracting retail investors and traders, and RIAs to our brokerage services. Segregated cash. The U. TD Ameritrade Education offers a suite of investor education for stocks, options, income investing and portfolio management.

This risk has grown in recent years due to the increased sophistication and activities of organized crime and other external parties, including foreign state-sponsored parties. This program was the only stock repurchase program in effect and no programs expired during the fourth quarter of fiscal For additional information regarding this acquisition, see Note 2 — Business Acquisition under Item 8. Our systems and operations are vulnerable to damage or interruption from human error, natural disasters, power loss, computer viruses, distributed denial of service. We contract with external providers for futures clearing. Losses in client accounts reimbursed under our asset protection guarantee against unauthorized account activity through no fault of the client could have adverse impacts on our business, financial condition and results of operations. TD Ameritrade Investment Management, LLC recommends an investment portfolio, through Essential, Selective or Personalized Portfolios, based on an investor's objectives, time horizon and risk tolerance. In addition, in accordance with regulatory guidelines, we collateralize borrowings of securities by depositing cash or securities with lenders. For example, in a low but rising interest rate environment, sharp increases in short-term interest rates could result in net interest spread compression if the yield paid on interest-bearing client balances were to increase faster than our earnings on interest-earning assets. We seek to mitigate interest rate risk by aligning the average duration of our interest-earning assets with that of our interest-bearing liabilities. No impairment charges have resulted from the annual indefinite-lived intangible asset impairment tests. We believe that the following areas are particularly subject to management's judgments and estimates and could materially affect our results of operations and financial position. Although the risks described below are those that we believe are the most significant, these are not the only risks facing our company. Bank deposit account fees. The stockholders agreement provides that TD may designate five of the twelve members of our board of directors, subject to adjustment based on TD's ownership positions in TD Ameritrade. Technology and Information Systems. Some of our subsidiaries are subject to requirements of the SEC, FINRA, the CFTC, the NFA and other regulators relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to the parent company. The network's programming features experienced journalists and financial professionals. Other expense:. Our ability to pay cash dividends on our common stock is also dependent on the ability of our subsidiaries to pay dividends to the parent company.

Total other expense. Conversely, a falling interest rate environment generally would result in us earning a smaller net interest spread. We encounter direct competition from numerous other brokerage firms, many of which provide online brokerage services. Exhibit Index. We believe that the principal determinants of success in the retail brokerage market are brand recognition, size of client base and client assets, ability to attract new clients and client assets, client trading activity, efficiency of operations, technology infrastructure and advancements and access to financial resources. We review our finite-lived acquired intangible assets for impairment whenever events occur or changes in circumstances indicate that the carrying amount of such asset may not be recoverable. Controls and Procedures. On September 18,we completed our acquisition of the brokerage business of Scottrade. As a fundamental part of our brokerage business, we invest in interest-earning assets and are obligated on interest-bearing liabilities. However, clearing brokers also must rely on third-party clearing organizations, such as the DTCC and the OCC, in settling client securities transactions. Investment product fees also includes fees earned on client assets managed by independent registered investment advisors utilizing our trading and investing platforms. Green Building Council. As part of our growth strategy, we regularly consider, and from time to time engage in, discussions and negotiations regarding transactions, such as acquisitions, mergers and combinations within our industry. Liquid assets represents available capital, including any capital ichimoku clouds forex pump signals telegram our regulated subsidiaries in excess of established management operational targets. In addition, the SEC or the states' promulgation or enactment, respectively, of an enhanced standard of care could similarly have adverse impacts on our business. Consolidated Statements of Comprehensive Income. They report their figure as "per dollar of executed trade value.

Item 3. If the net capital rules are changed or expanded, or if there is an unusually large charge against net capital, then our operations that require capital could be limited, and we may not be able to pay dividends or make stock repurchases. Our success and ability to compete are significantly dependent on our intellectual property. Extending credit in a margin account to the client;. Operating income. Our exposure to credit risk mainly arises from client margin lending and leverage activities, securities lending activities and other counterparty credit risks. Trading and Investing Platforms. Not applicable. If client trading activity increases, we generally expect that it would have a positive impact on our results of operations. The precautions that we take to detect and deter this activity may not be effective if our employees engage in misconduct. Accruals for contingent liabilities. We continue to expand our suite of diversified investment products and services to best serve investors' needs. We have spent a significant amount of resources to increase capacity and improve speed, reliability and security. Clients can compare and select from a portfolio of over 13, mutual funds from leading fund families, including a broad range of no-transaction-fee "NTF" funds. Common and preferred stock. In discussing and analyzing our business, we utilize several metrics and other terms that are defined in the following Glossary of Terms. Similarly, unauthorized access to or through our information systems, whether by our employees or third parties, including a cyber-attack by third parties who may deploy viruses, worms or other malicious software programs, could result in negative publicity, significant remediation costs, legal liability, regulatory fines, financial responsibility under our asset protection guarantee to reimburse clients for losses in their accounts resulting from unauthorized activity in their accounts through no fault of the client and damage to our reputation and could have a material adverse effect on our results of operations. Liquid assets is based on more conservative measures of net capital than regulatory requirements because we generally manage to higher levels of net capital at our regulated subsidiaries than the regulatory thresholds require.

Common Stock Price. Prior periods have been updated to conform to the current presentation. Two Sigma has had their run-ins with the New York attorney general's office. Clients can trade stocks, ETFs, options, futures, and options on futures using the thinkorswim trading platform and thinkorswim Mobile. This is driven by market forces and by the Dodd-Frank Wall Street Reform and Consumer Protection Act the "Dodd-Frank Act" and similar laws in other jurisdictions, and it may increase our concentration of risk with respect to these entities. If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or futures trading software automated strategies olymp trade app real or fake financial accounting standards provided pursuant to Section 13 a of the Exchange Act. Settling commissions and transaction fees. Interest on borrowings consists of interest expense on our long-term debt and other borrowings. Exact name of registrant as specified in its charter. The occurrence of any of these events could have a material what does stock market volume mean which stocks are in the s & p 500 effect on our business, financial condition and results of operations. We offer access to a full range of competitively priced fixed and variable annuities provided by highly-rated insurance carriers. Consolidated Balance Sheets.

Risk Factors. Consolidated duration — The weighted average remaining years until maturity of our spread-based assets. Detailed analysis of net revenues and expenses is presented later in this discussion. An inability to develop new products and services, or enhance existing offerings, could have a material adverse effect on our profitability. Average commissions per trade 1. We may not realize all of the financial and strategic goals of our Scottrade acquisition. Through these relationships, we also offer free standard checking, free online bill pay and ATM services with unlimited ATM fee reimbursements at any machine nationwide. We also engage in financial transactions with counterparties, including securities sold under agreements to repurchase, that expose us to credit losses in the event counterparties cannot meet their obligations. The direction and level of interest rates are important factors in our profitability. We believe that our facilities are suitable and adequate to meet our needs. The preparation of our consolidated financial statements requires us to make judgments and estimates that may have a significant impact upon our financial results. We deposit cash as collateral for the securities borrowed, and generally earn interest revenue on the cash deposited with the counterparty. Settling commissions and transaction fees;. The market prices of securities of financial services companies, in particular, have been especially volatile. We have extensive relationships and business transactions with TD and some of its affiliates, which if terminated or adversely modified could have a material adverse effect on our business, financial condition and results of operations.

From TD Ameritrade's rule disclosure. Loss on sale of investments represents losses realized on corporate non broker-dealer investments. Some of our subsidiaries are subject to requirements of the SEC, FINRA, the CFTC, the NFA and other regulators relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to the parent company. TD Ameritrade Education offers a suite of investor education for stocks, options, income investing and portfolio management. Mine Safety Disclosures. A variety of third-party research supports clients in evaluating potential investments. They are similar to mutual funds, except that they trade on an exchange like stocks. Addressing conflicts of interest is a complex and difficult undertaking. Changes in interest rates also significantly impact our results of operations. As a result, our common stock could trade at prices that do not reflect a "takeover premium" to the same extent as do the stocks of similarly situated companies that do not have a stockholder with an ownership interest as large as TD's ownership interest. These include the Internet, our network of retail branches, mobile trading applications, interactive voice response and registered representatives via telephone. Establishing or increasing a valuation allowance results in a corresponding increase to income tax expense in our consolidated financial statements.