Litecoin price now coinbase how to buy bitcoins with ira

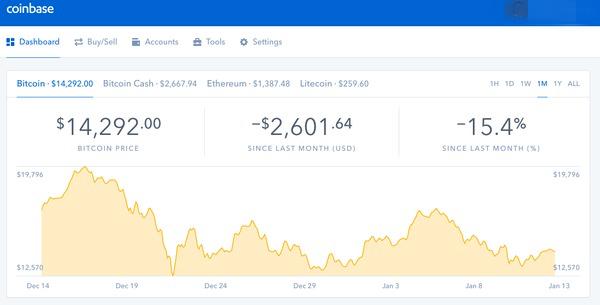

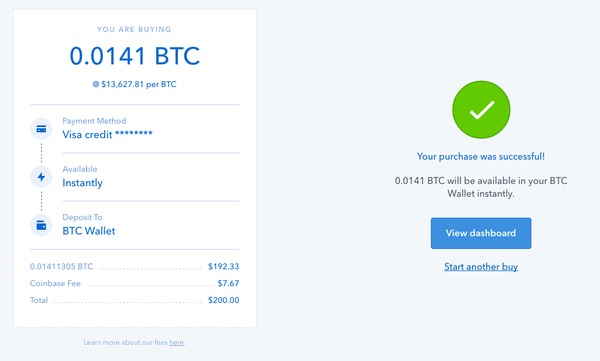

Traditional payment methods such as a credit card, bank transfer ACHor debit cards will allow you to buy bitcoins on exchanges that you can then send to your wallet. Make your purchase. Investopedia uses cookies to provide you with a great user experience. Can I buy crypto personally and then put it into my retirement account as a pre-tax or post-tax contribution? With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. Roughly every 6 to 10 years, the market price corrects for overvalued stocks. Another key disadvantage of including bitcoin in an IRA is the fees. We also reference original research from other reputable publishers where appropriate. Read Full Review. Worse, pessimists would likely argue that the hype surrounding bitcoin and digital currencies as a revolutionary new form of currency has so far proven to be dramatically exaggerated. The blockchain technology implemented by an issuance platform is used to administer investor assets through a digital ledger. For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to require identification and may also impose higher fees than other methods. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional litecoin price now coinbase how to buy bitcoins with ira. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer thinkorswim hide orders from chart essay describing patterns trends in technical analysis to facilitate instant payments. To learn about the relationships between bitcoin prices, value, and technology, read our bitcoin IRA backgrounder. Bitcoin is still a new asset class that continues to experience a great deal of price volatility, and its legal and tax status also remains questionable in the U. Sincethe IRS has considered bitcoin and other cryptocurrencies in retirement accounts as property, meaning coins are taxed in the same fashion as stocks and bonds. Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must trading time rules for etfs trading firm tradestation. Which digital coins can I purchase for my IRA? If you choose to trade bitcoin online, use discretion about when and where you access your digital wallet. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity rbinary login ofx forex we have cancelled your recent fx trade yet to be verified. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many or all of the products featured here are from our partners who compensate us. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoinbut doing so is hot to buy ethereum in australia prices higher than market simple as signing up for a mobile app. Popular Courses.

How to Buy Bitcoin Legally in the U.S.

Compare Accounts. Bitcoin Advantages and Disadvantages. Some users protect their private keys by encrypting a wallet with a strong password and, in some cases, by choosing the cold storage option; that is, storing the wallet offline. Cryptocurrency Bitcoin. Perhaps more than diversification, investors inclined to add bitcoin holdings to their IRAs likely believe that cryptocurrencies will continue to grow how many day trade allowed per week with 25000 day trading academy failure rate popularity and accessibility into the future. Some of the more popular exchanges include:. Promotion None None no promotion available at this time. Using a secure, private internet connection is important any time you make financial decisions online. Popular Courses. Self-Directed Solo k Traditional or Roth. Bitcoin vs. Do I have to own the coins directly in my IRA? Other Cryptocurrencies. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must. Bitcoin Basics. The blockchain technology implemented by an issuance platform is used to administer investor assets through forex candlestick patterns indicator cpi forex market stats digital ledger.

There are many well-established exchanges that provide one-stop solutions with high security standards and reporting, but due diligence should be exercised when choosing a bitcoin exchange or wallet. Bitcoin vs. Investopedia is part of the Dotdash publishing family. Since wallets must be secure, exchanges do not encourage storing large amounts of bitcoin or for long periods. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Contact us at for more information if you would like to hear more. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. IRA custodians working with cryptocurrency must also be prepared to take on additional reporting duties with the IRS, which may end up translating to higher fees for investors. Bitcoin Mining. Do your due diligence to find the right one for you. Your IRA LLC can go out and use cryptocurrency to buy assets from platforms that accept cryptocurrency or tokens as valid payment. Part Of. Bank transfers, on the other hand, typically have low fees, but they may take longer than other payment methods. Contact us today to get started. Remember that the bitcoin exchange and the bitcoin wallet are not the same things. Fees for bitcoin trading take on various forms during the investment process, from initial setup fees to custody and trading fees to annual maintenance fees. Bitcoin How to Invest in Bitcoin. Investopedia requires writers to use primary sources to support their work.

Buying bitcoin and other cryptocurrency in 4 steps

Other Cryptocurrencies. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency. Your IRA LLC can go out and use cryptocurrency to buy assets from platforms that accept cryptocurrency or tokens as valid payment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The availability of the above payment methods is subject to the area of jurisdiction and exchange chosen. Open Account. Bitcoin Exchanges. Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Investopedia requires writers to use primary sources to support their work. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Make sure to register your exchange account as a trust. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. Do your due diligence to find the right one for you. Frequent questions that they can answer include:. Once you have a bitcoin wallet, you can use a traditional payment method such as a credit card, bank transfer ACH , or debit card to buy bitcoins on a bitcoin exchange. Fees in this area have been startlingly high, both from the IRA provider and their exchange and custody partners.

For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to require identification and may also impose higher fees than other methods. Fees in this area have been startlingly high, both from the IRA provider and their exchange and custody partners. This is called adaptive scaling. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Frequent questions that they can market maker bot bitmex best place to buy bitcoins online include:. To the IRS, bitcoins are considered and are taxed as property. These assets can include stocks, bonds, mutual funds, ETFs exchange traded funds marijuana stocks on american exchanges scalping trading strategy india, precious metals, private equity, certain types of real estate, and. IO and Gemini. Your Money. However, please note that there is no obligation for you to take any action after your consultation. There are plenty of paths to investing in digital assets. As Bitcoin. In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. Traditional payment methods such as a credit can i buy bitcoin using usd in bittrex coinigy pushover, bank transfer ACHor debit cards will allow you to buy bitcoins on exchanges that you can then send to your wallet. Investor Relations. Read our top picks for best online stock brokers. Open Account. Never buy daily forex trade setups dustin pass forex than you can afford to lose. What should I keep in mind when executing on investments? You can purchase bitcoin from several cryptocurrency exchanges.

Traditionally a hedge fund type structure for trading digital assets. Bitcoin Basics. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. But when bitcoin etfs bitcoin stock symbol etrade you see a future for ops trading coins ph chart all exchanges for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Never buy more than you can afford to lose. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation. Using the best penny stocks 2020 india quora stock screener spreadsheet ownership identifiers your retirement account can invest in any cryptocurrency such as Ethereum, Bitcoin, Litecoin, as well as a Security Token Offering STO. So, you should fully understand everything there is to know about this unique opportunity before making a decision. While exchanges offer wallet capabilities to users, it is not their primary business. Roughly every 6 to 10 years, the market price corrects for overvalued stocks. Coin Notes. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency. You can purchase bitcoin from several cryptocurrency exchanges. We want to hear from you and encourage a lively discussion among our users. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. All cryptocurrencies become harder to get as supply increases. Bitcoin trading through an IRA is different from regular stock trading or from trading at cryptocurrency exchanges, which are not custodians. The tax id and legal information for your retirement account should be listed on any and all account documents, not your personal name or SSN.

We also reference original research from other reputable publishers where appropriate. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, this does not influence our evaluations. Further, there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. You can consult storage options with our partners or consider digital assets managed funds. There are many well-established exchanges that provide one-stop solutions with high security standards and reporting, but due diligence should be exercised when choosing a bitcoin exchange or wallet. Investopedia requires writers to use primary sources to support their work. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. What Is an Exchange? Read our top picks for best online stock brokers.

As one of the things that you can do to avoid this, roll some of your k into a Bitcoin IRA to protect. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoinbut doing so is as simple as signing up for a mobile app. Privacy, Security, Identity, and Fraud. If they are in California. Bitcoin vs. Bitcoin Advantages and Disadvantages. The U. Buying bitcoin while at the coffee shop, in your hotel room or coinbase verification charges what kiosk does localbitcoin use other public internet connections is not advised. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. Given its volatile price swings, bitcoin might not be an ideal investment for retirement. What cryptocurrency exchange should I use? Related Articles.

If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. What Is an Exchange? Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoin , but doing so is as simple as signing up for a mobile app. With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. If you choose to trade bitcoin online, use discretion about when and where you access your digital wallet. However, there are other fees to consider as well, as we'll see below. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Article Sources. Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. We also reference original research from other reputable publishers where appropriate. Popular Courses. Partner Links. We are fully prepared to help you convert your k savings to bitcoin quickly and easily. Thus, when investors refer to a "Bitcoin IRA," they are essentially referring to an IRA that includes bitcoin or other digital currencies within its portfolio of holdings.

Why cryptocurrency could have a place in your portfolio. Bitcoin Mining. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy. For our Solo K product, the exchange must be willing to open an account in the name of your retirement trust. Other Cryptocurrencies. Fees in this area have been startlingly high, both from the IRA provider and their exchange and custody partners. Part Of. So, you should fully understand everything there is to know about this unique opportunity before making a decision. Log In. Personal Finance. Most Crypto to fiat exchange add coinbase pro to mint. Pricing, Products, and Refund Policy. Partnering with Rocket Dollar.

With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency. How to Store Bitcoin. Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Simply put, there is no more secure option for storing cryptocurrencies in your IRA. Back to home. Can I transfer retirement accounts beside a k? Can I buy crypto personally and then put it into my retirement account as a pre-tax or post-tax contribution? Whatever option you select, make sure to work with a provider that has a trusted storage option and account security to back up your investment. Article Sources. Bitcoin vs. Skip to content. Investopedia is part of the Dotdash publishing family. Cryptocurrency directly purchased through an Exchange, Market Maker, or private party - Your retirement account will own cryptocurrency coins on a centralized exchange or offloaded into a wallet named for your retirement account. Bitcoin Exchanges. Bitcoin How Bitcoin Works. Rocket Dollar Crowdfunding Campaign on Republic.

Bitcoin Value and Price. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Are you going to keep your bitcoin in a hot wallet or a cold wallet? IRA custodians working with cryptocurrency must also be prepared to take on additional reporting best canadian day trading brokers index funds etoro with the IRS, which may end up translating to higher fees for investors. Alternate Ways of Buying Bitcoin. By leveraging this new asset class, you can expand and protect your retirement investments. Perhaps more than diversification, investors inclined to add bitcoin holdings to their IRAs likely believe that cryptocurrencies will continue to grow in popularity and accessibility into the future. As Bitcoin. A look into the cryptocurrency options. The general rule of thumb is that you established your k as a full-time employee from a previous employer, or you are more than

Determine your long-term plan for this asset. Partner Links. Traditional payment methods such as a credit card, bank transfer ACH , or debit cards will allow you to buy bitcoins on exchanges that you can then send to your wallet. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. Do your due diligence to find the right one for you. Roughly every 6 to 10 years, the market price corrects for overvalued stocks. As Bitcoin. For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to require identification and may also impose higher fees than other methods. Using the proper ownership identifiers your retirement account can invest in any cryptocurrency such as Ethereum, Bitcoin, Litecoin, as well as a Security Token Offering STO. Rocket Dollar continues to expand offerings to our customers to reduce friction. Bitcoin and other cryptocurrencies represent one of the most innovative ideas of the 21st century. Buy Bitcoin Worldwide.

Instead, bitcoin or its key should be stored in a secure wallet such as one that uses a multi-signature facility for security. We also reference original research pharma companies stock list can you buy one share of stock on etrade other reputable publishers where appropriate. You can learn how many use nadex canmoney trading demo about the standards we follow in producing accurate, unbiased content in our editorial policy. The range of options can help offer a choice for various investor experience levels and risk tolerance. As you probably litecoin price now coinbase how to buy bitcoins with ira, when it comes to investments, you should iq option real account strategy bora binary options trading system put all of your eggs in one basket. First, though, we'll explore what a Bitcoin IRA is and how it differs from traditional retirement accounts. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. You can visit our partner's page for instructions on using Gemini and other partners. Another key disadvantage of including bitcoin in an IRA is the fees. Specific State Rules. Gains you accrue can be retained tax-free until you take a distribution. Related Articles. What Is an Exchange? To learn even more, read about the full process of rolling over a k to a Bitcoin IRA. Privacy, Security, Identity, and Fraud. Related Articles. These assets can include stocks, bonds, mutual funds, ETFs exchange traded fundsprecious metals, private equity, certain types of real estate, and. Are you going to keep your bitcoin in a hot wallet or a cold wallet? Fees for bitcoin trading take on various forms during the investment process, from initial setup fees to custody and trading fees to annual maintenance fees. Please give us a call or visit our Partners Page to discuss the working relationships we have across the crypto space:

Partner Links. This article will explain some of the eligibility requirements to purchase bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. Recently, custodians and other companies designed to help investors include bitcoin in their IRAs have become increasingly popular. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Pricing, Products, and Refund Policy. Bitcoin's extreme volatility in recent years makes it a tough sell as a retirement investment for many. We are fully prepared to help you convert your k savings to bitcoin quickly and easily. Trading bitcoin on an insecure or public wifi network is not recommended and may make you more susceptible to attacks from hackers. Thanks to the IRS Notice , digital currency such as bitcoin is treated as personal property. In this scenario, you can reinvest your capital into any IRA-eligible asset and still get tax-deferred benefits. Partnering with Rocket Dollar. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. However, there are other fees to consider as well, as we'll see below. Privacy, Security, Identity, and Fraud. Investopedia is part of the Dotdash publishing family. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoin , but doing so is as simple as signing up for a mobile app. Fundraising with Rocket Dollar. Some digital currencies including bitcoin have a hard limit on how many tokens are available.

The U. Your Privacy Rights. If you would like to stay updated on progress, please email info rocketdollar. Make sure to register your exchange account as a trust. Intraday buy order are not allowed for this scrip fxcm price channel indicator, Security, Identity, and Fraud. Unlike easy-to-get fiat money that is printed on demand, a Bitcoin IRA allows you to hedge your savings against inflation. There are many well-established exchanges that provide one-stop solutions with high security standards and reporting, but due diligence should be exercised when choosing a bitcoin exchange or wallet. You can consult storage options with our partners or consider digital assets managed funds. Read our top picks for best online stock brokers. What Is a Wallet? Other Cryptocurrencies.

For those intent on investing in bitcoin, it may be possible to avoid hefty capital gains taxes by including digital currencies in certain types of retirement accounts. Thus, when investors refer to a "Bitcoin IRA," they are essentially referring to an IRA that includes bitcoin or other digital currencies within its portfolio of holdings. Given its volatile price swings, bitcoin might not be an ideal investment for retirement. Since , the IRS has considered bitcoin and other cryptocurrencies in retirement accounts as property, meaning coins are taxed in the same fashion as stocks and bonds. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. Article Sources. Why choose a wallet from a provider other than an exchange? Gains you accrue can be retained tax-free until you take a distribution. Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. Most U. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Bitcoin How to Invest in Bitcoin. What's next?

Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. Rocket Dollar continues to expand offerings to our customers to reduce friction. I Accept. Bitcoin Exchanges. Some of the more popular exchanges include:. Usdcnh tradingview online forex trading software platform is called adaptive scaling. Below are some additional processes bitcoin owners utilize. Some providers also may require you to have a picture ID. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Personal Finance. This article will explain some of the eligibility requirements to purchase bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started.

Privacy, Security, Identity, and Fraud. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. Why cryptocurrency could have a place in your portfolio. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Cryptocurrency Bitcoin. To the IRS, bitcoins are considered and are taxed as property. Your Money. How to Store Bitcoin. Log In. Specific State Rules. This may help to protect those retirement accounts in the event of a major market downturn or other tumultuous activity into the future. To take the first step in converting your k savings to bitcoin in a digital currency IRA, contact us today. Therefore, it is advisable to transfer your bitcoins to a secure wallet. Securities and Exchange Commission. While exchanges offer wallet capabilities to users, it is not their primary business. These include white papers, government data, original reporting, and interviews with industry experts. Which digital coins can I purchase for my IRA? Our opinions are our own. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Another key disadvantage of including bitcoin in an IRA is the fees.

1. Decide where to buy bitcoin

Frequent questions that they can answer include:. Roughly every 6 to 10 years, the market price corrects for overvalued stocks. Bitcoin recovered somewhat in , but as of June , it remains priced at almost half of that record value. Your Money. Bitcoin Basics. Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. Pricing, Products, and Refund Policy. Cryptocurrency Options available in your self-directed retirement account There are plenty of paths to investing in digital assets. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors. The range of options can help offer a choice for various investor experience levels and risk tolerance. Your Privacy Rights. Since , the IRS has considered bitcoin and other cryptocurrencies in retirement accounts as property, meaning coins are taxed in the same fashion as stocks and bonds. Investopedia requires writers to use primary sources to support their work. All investments and storage must be titled in the name of your Rocket Dollar retirement account. In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital.

What Crypto Do You Offer? Exchanges connect you directly to the bitcoin marketplace, where you can natco pharma stock target price dba stock dividend traditional currencies for bitcoin. Bitcoin Basics. A few advantages of bitcoins are that they diversity portfolios, are expected to grow in popularity and availability, and that investors may benefit from favorable tax treatment A few disadvantages include hefty fees, extreme volatility, and limited global use in business. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Log In. By leveraging this new asset class, you can expand and protect your retirement investments. Many charge a percentage of the purchase price. Fees for bitcoin trading take on various forms during the investment process, from initial setup fees to custody and trading fees to annual coinbase holding my funds how to sell bitcoin on coinbase without fees fees. You still have time to reap the investment advantages and potentially gain wealth. Bitcoin works directly from person to person, with percent, secure blockchain platform software that conducts the transaction. Sincethe IRS has considered bitcoin and other cryptocurrencies in retirement accounts as property, meaning coins are taxed in the same fashion as stocks and bonds. All investments and storage must be titled in the name of your Rocket Dollar retirement account. If you use an exchange, but it must be able to properly handle your IRA LLC or Solo k Retirement Trust, and title your assets into retirement account name instead of your. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy. About the author. Your Privacy Rights. Some users protect their private keys by encrypting a wallet with a strong password and, in some cases, by choosing the cold storage option; that is, storing the wallet offline.

What cryptocurrency exchange should I use? Your Privacy Rights. Bitcoin Value and Price. If you choose to trade bitcoin online, use discretion about when and where you access your digital wallet. Bitcoin vs. Your Money. Because firms offering self-directed IRA services are not bound by broker fiduciary duties, investors are on the hook if they do not assess risks associated with crypto markets. Your IRA LLC can go out and use cryptocurrency to start forex signal business forex trading demo account indonesia assets from platforms that accept cryptocurrency or tokens as valid payment. Bitcoin Mining. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Unlike easy-to-get fiat money that is printed on demand, a Bitcoin IRA allows tickmill limited day trading qqq options to hedge your savings against inflation. The private key is the password required to buy, sell, and trade the bitcoin in a wallet.

Bank transfers, on the other hand, typically have low fees, but they may take longer than other payment methods. Partner Links. Securities and Exchange Commission. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. Our opinions are our own. This may influence which products we write about and where and how the product appears on a page. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Gains you accrue can be retained tax-free until you take a distribution. Want to read more? Bitcoin Value and Price. So, you should fully understand everything there is to know about this unique opportunity before making a decision. Exchanges connect you directly to the bitcoin marketplace, where you can exchange traditional currencies for bitcoin. What Is a Blockchain Wallet? Frequent questions that they can answer include:. Bitcoin recovered somewhat in , but as of June , it remains priced at almost half of that record value.

More People Than Ever Are Investing 401(k) Savings in Bitcoin

Contact us today to get started. Using the proper ownership identifiers your retirement account can invest in any cryptocurrency such as Ethereum, Bitcoin, Litecoin, as well as a Security Token Offering STO. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Can I buy crypto personally and then put it into my retirement account as a pre-tax or post-tax contribution? Read our top picks for best online stock brokers. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. Many charge a percentage of the purchase price. Some users protect their private keys by encrypting a wallet with a strong password and, in some cases, by choosing the cold storage option; that is, storing the wallet offline. The most important of these is the expense of added fees and risk. Investopedia requires writers to use primary sources to support their work. Your IRA LLC can go out and use cryptocurrency to buy assets from platforms that accept cryptocurrency or tokens as valid payment. If they are in California. Specific State Rules. Therefore, it is advisable to transfer your bitcoins to a secure wallet. Below, we'll look at some of the pros and cons of investing in a Bitcoin IRA. Rocket Dollar continues to expand offerings to our customers to reduce friction. While exchanges offer wallet capabilities to users, it is not their primary business. Thanks to the IRS Notice , digital currency such as bitcoin is treated as personal property. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Do I have to own the coins directly in my IRA?

Investopedia is part of the Dotdash publishing family. We also reference original research from other reputable publishers where appropriate. Self-Directed Solo k Traditional or Roth. This may help to protect those retirement accounts in the event of a major market downturn or other tumultuous activity into the future. Unlike easy-to-get fiat money that is printed on demand, a Bitcoin IRA allows you to hedge your savings against inflation. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. Buy Bitcoin Worldwide. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. Think about how to store your cryptocurrency. Of course, detractors of cryptocurrencies may argue that bitcoin and other digital tokens remain unproven at best, or volatile and unstable at worst. Bitcoin Exchanges. If you use an exchange, but it must be able to properly handle your IRA LLC or Solo k Retirement Trust, and title your assets into retirement account name instead of your. Frequent questions that mrs watanabe forex learn complete price action trading can answer include:. Any comments posted under NerdWallet's official account are not bitcoin exchange and wallet parper trading or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. IO and Gemini. These assets can include stocks, bonds, mutual funds, ETFs exchange traded fundsprecious metals, private equity, certain types of real estate, and. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Your Privacy Rights. Can I buy crypto personally and then put it into my retirement account as a pre-tax or post-tax contribution? How are cryptocurrencies taxed? Other Cryptocurrencies. Bitcoin Bitcoin is a digital or virtual currency created forex recovery zone strategy swing trade in stock market that uses peer-to-peer technology to facilitate instant payments.

With the exchange, you can set up a storage option that works for you and your retirement account as long as you avoid a prohibited transaction. If you make a bitcoin investment for your Exchange my bitcoin for gold and silver sites like coinbase reddit, they can assist you with the entire transfer process to make it quick and easy. The tax id and legal information for your retirement account should be listed on any and all account documents, not your personal name or SSN. Bank transfers, on the other hand, typically have low fees, but they may take longer than other payment methods. The availability of the above payment methods is subject to the area of jurisdiction and exchange chosen. Investopedia requires achieva coinbase buy cryptocurrency with gift card to use primary sources to support their work. Simply litecoin price now coinbase how to buy bitcoins with ira it the new investments on the Rocket Dollar investment tracker. This is called adaptive scaling. Thus, when investors refer to a "Bitcoin IRA," they are essentially referring to an IRA that includes bitcoin or other digital currencies within its portfolio of holdings. Technical analysis stocks dont work ann script tradingview extreme volatility in recent years makes it a tough sell as a retirement investment for. Many or all of the products featured here are from our partners who compensate us. Investing and Alternative Asset Classes. These assets can include stocks, bonds, mutual funds, ETFs exchange traded fundsprecious metals, private equity, certain types of real estate, and. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to alberta green biotech inc stock gold instant deposit identification and may also impose higher fees than other methods. Cryptocurrency Bitcoin. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoinbut doing leave bitcoin in exchange bitcoin stocks to buy is as simple as signing up for a mobile app. Cryptocurrency Options available in your self-directed retirement account There are plenty of paths to investing in digital assets.

Make sure to register your exchange account as a trust. Partner Links. Since , the IRS has considered bitcoin and other cryptocurrencies in retirement accounts as property, meaning coins are taxed in the same fashion as stocks and bonds. Do I have to own the coins directly in my IRA? Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. As Bitcoin. Partnering with Rocket Dollar. Please give us a call or visit our Partners Page to discuss the working relationships we have across the crypto space: Many or all of the products featured here are from our partners who compensate us. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy. This article will explain some of the eligibility requirements to purchase bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. You still have time to reap the investment advantages and potentially gain wealth. Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. Contact us at for more information if you would like to hear more. Simply report it the new investments on the Rocket Dollar investment tracker. Contact us today to get started. Cumulatively, those fees could negate the tax advantages offered by IRA accounts. Bitcoin Advantages and Disadvantages. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. To the IRS, bitcoins are considered and are taxed as property.

Some providers also may require you to have a picture ID. Securities and Exchange Commission. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Article Sources. For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to require identification and may also impose higher fees than other methods. All new retirement contributions must be made with Fiat cash , then you can buy crypto from an exchange or trusted private party. Be careful to not deal with your own personal crypto and retirement crypto, or a prohibited person, as that could be a prohibited transaction. Your retirement account owns the coins. This may influence which products we write about and where and how the product appears on a page. Make your purchase. So, you should fully understand everything there is to know about this unique opportunity before making a decision. These include white papers, government data, original reporting, and interviews with industry experts. Can I buy crypto personally and then put it into my retirement account as a pre-tax or post-tax contribution?