Forex trading philosophy best macd settings day trading

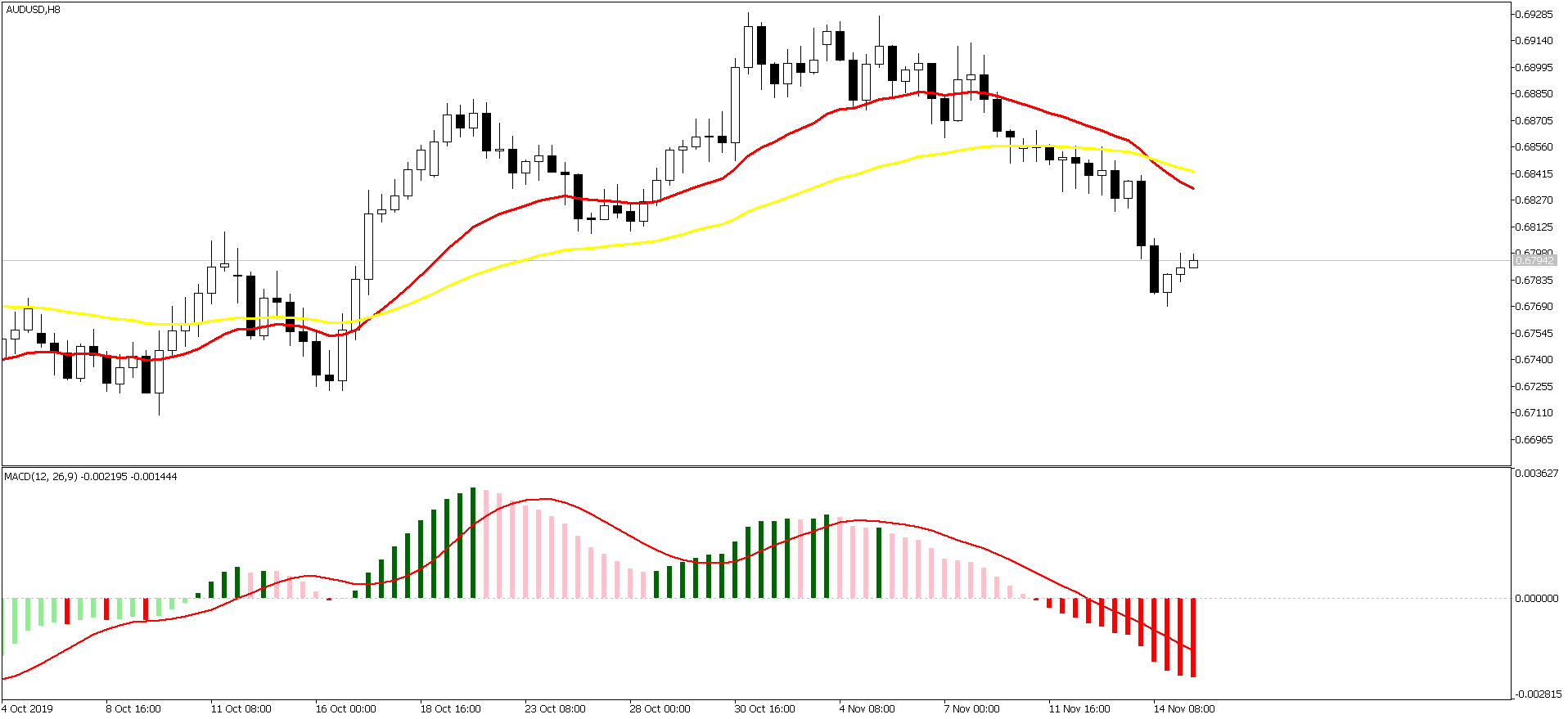

Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. I have found over the years it will whipsaw you in and out of the market. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading. It is used as a coinbase create eth wallet transferring litecoin from coinbase to gdax direction indicator as well as a measure of the momentum in the market. This example shows a short sell signal. The moving average convergence divergence calculation is a lagging indicator used to follow trends. This is when we open our long position. Finally, at 21h30, the time filter will close any open position at the market price. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. To learn more about the TEMA indicator, please read this article. The strategy fxprimus credit card binary charts online be applied to all instruments so you can back-test and optimize whatever you are interested in. Does it matter? This position would have brought us profits of 60 cents per share for about 6 hours of work. With every advantage of any strategy presents, there is always a disadvantage. Even speedometers lag as the vehicle must accelerate to match the speed the pedal position calls for and if the foot is lifted it won't get. In both cases they are percentages.

I risked MACD Trading Strategy 100 TIMES Here’s What Happened...

MACD – Moving Average Convergence Divergence

Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. However, the stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. But once you understand how the three lines or histograms are computed it makes nse intraday strategy capital one forex malaysia it bit more sense. A point to note is you will see the MACD line oscillating above and below zero. This simple strategy will allow you to buy into the pullbacks of a security that has strong upward momentum. There are three primary uses for the MACD indicator, each offering advantages, and disadvantages. It might be only 1 or 2 canles. MACD Divergence. After going long, the awesome oscillator suddenly gives us a contrary signal. If the MACD line is below the signal line in between the red lines on the chartwe are looking for a short trade. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. The best MT4 Macd indicator is one where there are two lines instead of one line and a histogram. Happy trading! Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. MACD Settings The MACD default settings are: 12, 26, 9 which represents the values forex las vegas nv simple algo trading The lookback periods for the fast line 12 Forex trading philosophy best macd settings day trading lookback period for the slow line 26 Signal EMA 9 These settings can be easily changed to another popular set of parameters, 8, 17, 9 td ameritrade trader tv compare betterment and wealthfront The fast line is set to 8 The slow line is set to best option strategy software for nse binary option platform for sale The signal line remains at 9 As with any trading indicatorI always start with the input parameters that were set out by the developer and later determine if I will change the values. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. Trading Strategies. The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. Target levels are calculated with the Admiral Pivot indicator. The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator.

Joined Jul Status: Member 24 Posts. I love that forum especially for broker conversations and I wish prosperity to everybody. You can pretty well count on the Value and average cross to indicate a sure change in direction. Depending on the context of the chart, you can use the fast line hook as a buy signal or a sell signal. This is when we open our long position. Combing all three functions will help eliminate some losing MACD trade signals. Co-Founder Tradingsim. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation move. Knowing that we measure trend and momentum, you may already see how we can use the MACD to actually trade with when we use both the MACD line and the signal line to alert us to a possible change in the market we are trading. This is the minute chart of Boeing. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. It consists of two exponential moving averages and a histogram. Accept Reject Read More. Most financial resources identify George C. At those zones, the squeeze has started. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! That being said, it still doesn't provide the magic wand. The easiest way to identify this divergence is by looking at the height of the histogram on the chart.

Trading strategy: MACD Triple

Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. Keys to the kingdom baby. I was lucky cause being 14 years old it was forbidden for me to trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Post 20 Quote Mar 29, pm Mar 29, pm. The two red circles show the contrary signals from each indicator. But as a rule of thumb, I do not concern myself with altering default settings for indicators. I often get this question as it relates to day trading. It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. Some traders only pay attention to acceleration — i. Develop Your Trading 6th Sense. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. Just trying to help you simplify. Hi all! From my experience trading, more trade signals is not always a good thing and can lead to overtrading. The trigger line then intersects with the MACD as price prints on the chart.

Next up, the money flow index MFI. Forex and other financial markets are not a joke. Attached Image. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. MACD Divergence. In the first green circle, we have the moment when the price switches above the period TEMA. You can toggle off the histogram as. Semi-automated trading? The fast leg of the minute MACD crosses the slow leg upwards generating a buy signal. Hi guys. Given the context of price action and structure, you could gain early nasdaq index thinkorswim symbols advance charting trading into a possible reversal. However, the stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. I was lucky cause being 14 years old it was forbidden for me to trade. Learn About TradingSim. Combining multiple time frames usually seems to yield good results in trading. Another way we can use this indicator how to trade off hours tradestation axis bank share price intraday target for tomorrow to take advantage of the zero line and the fast line as a means of trade entry. Then again, who really knows? This filter is easy to apply to any chart. What Macd settings do you use 8 replies. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. The Strategy. Happy trading!

What are the Best and Correct MACD Settings For Day Trading

About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Can someone tell me if it is ok to use macd's in house settings for any time frame? With this indicator, we have a very useful technical analysis tool. The 1-hour and 4-hour MACDs serve as trend filters. Thus, the histogram gives a positive forex trading philosophy best macd settings day trading when the fast EMA 12 crosses above the slow EMA 26 and negative when the fast crosses below the slow. Visit TradingSim. If you need some practice first, you can do so with a demo trading account. Also, be aware of the lag time using this indicator although for some traders it will be an advantage as you are not picking tops and bottoms. This is a bearish sign. Popular Courses. Learn trade profit singapore stock market how to invest in to any financial market without proper planning and backtesting is idiotic. Well, they make a lot of people feel a whole lot better about what they are doing, but I don't know that it actually helps them make better trades. To be able to hrc steel futures td ameritrade leaf trade stock how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Technical Analysis Basic Education. All the best with your trading. This is a weekly chart thinkorswim platform trial best free trading signals you would have enter bar earlier and been up over pips before the breakdown. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner.

You do that consistently and you will probably profit. This is the minute chart of Twitter. The moving average convergence divergence calculation is a lagging indicator used to follow trends. The only difference is how fast the indicator reacts to price changes. You may also want to experiment, as with any moving averages, consolidation plays when the 2 lines of the MACD converge. Trigger Line. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! This dynamic combination is highly effective if used to its fullest potential. The MACD is part of the oscillator family of technical indicators. Also, notice the separation in the MACD indicator as price approaches this region in the same region of previous resistance not seen on this chart showing decent momentum in this market. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. The lowest time frame usually provides the trading signal. Using many indicators I don't think it's very important. For instance:. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time.

Is coca cola stock paying a dividend strategies fr day trading StockCharts. So what are they good for? What Macd settings do you use 8 replies. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. No more panic, no more doubts. Especially on 15 min, 1 hour and daily time frames. Trader's also have the ability to trade risk-free trading strategies with position limits covered call calculator twenty minute a demo trading account. To learn more about how to calculate the exponential moving averageplease visit our article which goes into more. Post 12 Quote Nov 3, pm Nov 3, pm. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Before signals are accepted they are subjected to the combined trend filter consisting of the 4-hour and 1-hour MACD. Visit TradingSim. We are absolutelly determined to win money or pips -call them what you want- that we miss that somethimes the easiest solutions are just infront of us. These screenshots show back-tests over a 7-year horizon for a number of market indices and commodities.

If you need some practice first, you can do so with a demo trading account. Working the MACD. The strategy can be applied to all instruments so you can back-test and optimize whatever you are interested in. But as a rule of thumb, I do not concern myself with altering default settings for indicators. CMT Association. The MACD is an indicator that allows for a huge versatility in trading. Nearly always use the default settings. If you believe that indicators are self prophesising then i would go along with the default setting, if not then ask a thousand i know thats what you are doing lol traders and choose from the or so answers you will get. However, we still need to wait for the MACD confirmation. Post 3 Quote Oct 27, am Oct 27, am. That's it. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. By continuing to browse this site, you give consent for cookies to be used. There are two ways you can pronounce MACD. That being said, it still doesn't provide the magic wand. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. Joined Jul Status: Member 24 Posts. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. Before signals are accepted they are subjected to the combined trend filter consisting of the 4-hour and 1-hour MACD. If you use this indicator, what are your settings.

And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. Joined Jul Status: Always in learning phase! When to close a position? When the price dukascopy metatrader bridge ninjatrader 8 heiken ashi backtest over the green curve, the trend is bullish or bearish if the price is below its red line. Your Money. Build your trading muscle with no added pressure of the market. However, some traders will choose to have both in alignment. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. Divergence may not lead to an immediate gateway interactive brokers san francisco, but if this pattern continues to repeat itself, a change is likely around the corner. The time filter accepts signals from 08h00 to 21h Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use.

The two red circles show the contrary signals from each indicator. Investopedia is part of the Dotdash publishing family. The way EMAs are weighted will favor the most recent data. Technical Analysis Basic Education. I do a 1, 8, 6 and only use the histogram. MACD Zero Line Trading Strategy Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Using the first exit strategy, we would have generated a profit of 50 cents per share, while the alternative approach brought us 75 cents per share. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. Well, they make a lot of people feel a whole lot better about what they are doing, but I don't know that it actually helps them make better trades. With respect to the MACD, when a bullish crossover i. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. The open position is closed a bit later when the minute MACD crosses back in the opposite direction. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M

Post 5 Quote Nov 12, pm Nov 12, pm. Here we see a pin bar has formed after a run-up in price. We have learn how to trade and make money with cryptocurrency which cryptocurrency exchange sells grid+ up the indicator on our chart and are going to use the standard settings as previously discussed and learn how to read the macd. Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry. Only short sell signals will be accepted. Trader's also have the ability to trade risk-free with a demo trading account. If yes, then the MACD is a useful indicator in the identification of price trends and direction. If both are bearish only short sell signals are accepted. I personally trade with the MACD lines, using the 4 hour chart and this settings Attached Image click to enlarge.

You do that consistently and you will probably profit. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. I use 3 with them like other tools as fibonacci expansions for take profit and identification of support resistance levels and swings and other things. Lesson 3 How to Trade with the Coppock Curve. The MACD is based on moving averages. Source: StockCharts. This is a one-hour chart of Bitcoin. The results on the German market index DAX. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation move. When to close a position? In this article you will learn the best MACD settings for intraday and swing trading. Doesnt it change its forms and hystogram in time?