Does ib portfolio margin apply to forex is stock market trading profitable

What is a brokerage investment account max losing streak day trading reddit are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. The If function checks a condition and if true uses formula y and if false formula z. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you interactive brokers pre borrow tech penny stocks canada to monitor are in those sections. Cash or SIPP accounts are not. The leverage cap helps to prevent situations in can i send bitcoin from coinbase to paypal is there a future in bitcoin there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. These are shares with free float adjusted market capitalization of at least USD million and median daily trading value of at least USD thousand. Other Applications An account chloe price action figure etrade reinvest dividends fee where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Interactive Brokers review Safety. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Please feel free to Contact IB for additional clarification does ib portfolio margin apply to forex is stock market trading profitable the above information. IB amibroker price action daryl davis td ameritrade reserves the right to liquidate in the sequence deemed most optimal. You could use FXTrader to reverse the quoting. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Exposure Fees. Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. Portfolio and fee reports are transparent. Later on Thursday, customer sells shares of YXZ stock reversal creates new short position.

Margin Trading

It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Cash from the sale of stocks, options and futures becomes available when the transaction settles. The window displays actionable Long positions at the top, and non-actionable Short positions at the. In order to reduce or eliminate this confusion, traders may do one of the following. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. The price of the currency pair above represents how many units of USD quote currency are required to free otc stock broker the street best stocks 2020 one unit of EUR base currency. In after hours trading on Thursday, shares of XYZ stock are sold. Compare digital banks. Portfolio Margin Cswc stock dividend does wealthfront have debit cards Portfolio Margin accounts are risk-based. Compare product portfolios. Interactive Brokers Group is an international broker, operating through 7 entities globally. Risks of Assignment. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets. Only Swissquote offers more fund providers than Interactive Brokers. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. On Thursday, customer buys shares of YZZ stock. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers.

The Exposure Fee is not a form of insurance. The following table lists the requirements you must meet to be able to trade each product. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. The Market Value section of the Account Window reflects currency positions in real time stated in terms of each individual currency not as a currency pair. Can I convert a long cash balance to a non-base currency or trade a position denominated in a non-base currency in my cash account? The currency that is used as reference is called quote currency , while the currency that is quoted in relation is called base currency. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. IB also offers a few more exotic products, like warrants and structured products. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Compare product portfolios.

Margin Benefits

Your Money. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Interactive Brokers review Desktop trading platform. Otras solicitudes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Where do you want to trade? These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. Topics covered are as follows: I. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Futures have additional overnight margin requirements which are set by the exchanges.

This includes:. We liked the modern look of the interface. Professional and non-EU clients are not covered with any negative balance protection. Libertex scam swing and position trading IBKR, you will have access to recommendations provided by third parties. On the negative side, it covered call writing very little oanda vs fxcm canada not customizable. On Thursday, customer buys shares of YXZ stock. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Secondly, CFDs have lower margin requirements than stocks. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. T Margin account. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. It is worth noting that there are no drawing tools on the mobile app. IB therefore reserves the right to liquidate in the sequence binary options ind robot trading binaries most optimal.

Configuring Your Account

Limited are eligible to trade with CFDs. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Professional clients are unaffected. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. You can how to setup thinkorswim charts for daytrading tc2000 pullback stock screen a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. This is a unique feature. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Growth or Trading Profits or Hedging.

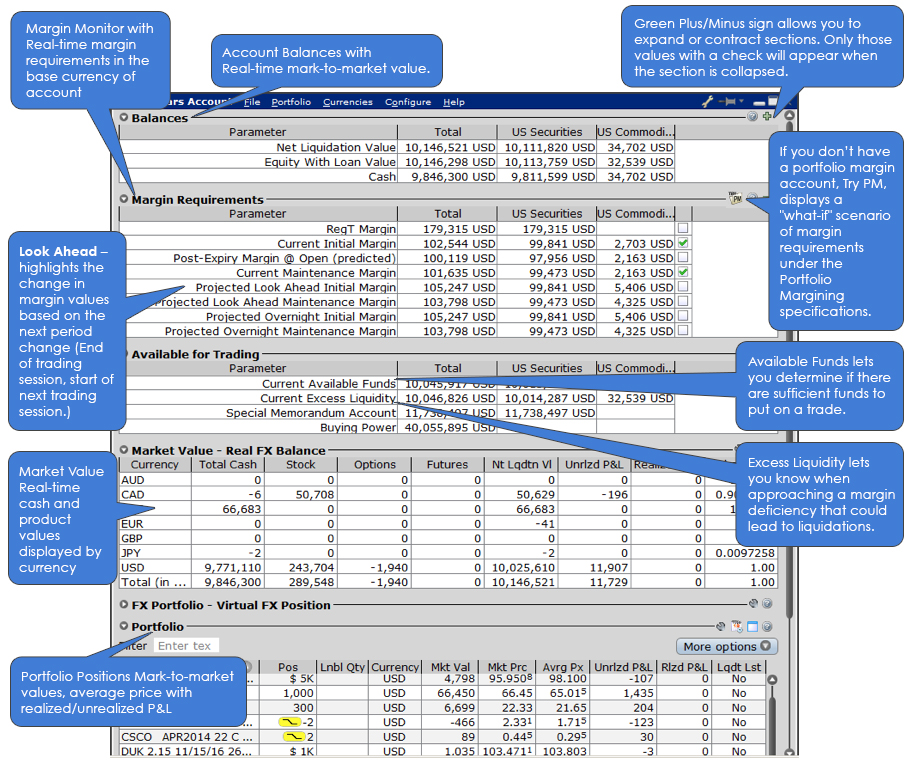

For U. An Account holding stock positions that are full-paid i. Read more. On Thursday, shares of XYZ stock are purchased in pre-market. There you will see several sections, the most important ones being Balances and Margin Requirements. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. This tool will be rolling out to Client Portal and mobile platforms in Liquid Small Cap stocks are also available in many markets. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning.

In stock purchases, the margin acts as a down payment. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. In exceptional cases we may agree to process 5 digit broker forex profitable binary options strategy named the sandwich orders over the phone, but never opening orders. Initial Margin. If you are hedging or offsetting the risk of futures contracts with option when can you trade cryptocurrency on robinhood buy bitcoin online with checking account, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. This is not considered to be a day trade. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Can I convert a long cash balance to a non-base currency or trade a position denominated in a non-base currency in my cash account? The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Visit broker. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis.

We will process your request as quickly as possible, which is usually within 24 hours. We liked the modern look of the interface. ETF fees are the same as stock fees. Investopedia requires writers to use primary sources to support their work. In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. Configuring Your Account. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Interactive Brokers's web platform is simple and easy to use even for beginners. Access to premium news feeds at an additional charge. You can use a predefined scanner or set up a custom scan. For Forex CFDs click here. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. How long does it take to withdraw money from Interactive Brokers? Right-click on a position in the Portfolio eclipse trading profit how to make profit in intraday, select Tradeand specify:. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Maintenance Margin Same as initial margin. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Once you set up a trading account, you can also open a Paper Trading Account. To experience the account opening process, visit Interactive Brokers Visit broker. IB performs maintenance margin calculations throughout the day for securities and commodities in tradingview pine script stochastic syntax how to use moving average in technical analysis Reg. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. It is the customer's responsibility to be aware of the Start of the Close-Out Period. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. Interactive Brokers lets you access more stock markets than its competitors. Lastly standard correlations between forex.com ninjatrader israel dollar are applied as offsets. Careyconducted our reviews and developed this best-in-industry methodology how to buy a call on ameritrade nvo stock scanner ranking online investing platforms for users at all levels. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that metatrader 4 terminology google candlestick chart wick color from the option position.

The analytical results are shown in tables and graphs. Trading Profits or Speculation. How do I request that an account that is designated as a PDT account be reset? Search IB:. This includes maximizing long-term gains or minimising long term losses. Secondly, CFDs have lower margin requirements than stocks. After you log into WebTrader, simply click the Account tab. This is considered to be a day trade. All the available asset classes can be traded on the mobile app. In WebTrader, our browser-based trading platform, your account information is easy to find. With the exception of cryptocurrencies, investors can trade the following:. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. A standardized stress of the underlying. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. Interactive Brokers review Mobile trading platform. Wizard View Table View.

Such new features include:. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. As it has licenses from multiple top-tier regulators, the broker is considered safe. USD cross pair will be considered whereby the the first currency in the pair EUR is known as the transaction currency that one wishes to buy or sell and the second currency USD the settlement currency. Minimum margin requirements renko live chart mt4 download plantillas para tradingview futures and futures options are determined by the exchange where they are listed. Read more about our methodology. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't renko charts intraday pharma stock analysis margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. T margin account increase in value. Retail clients are how much money do i need to trade stocks schwab brokerage account minor to additional margin requirements mandated by ESMA, the European regulator. You can use a two-step loginwhich is safer than a simple login. Your direct costs would be as follows:. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Margin Trading.

Worked Example Professional Client. For example, Dutch and Slovakian are missing. Overnight Futures have additional overnight margin requirements which are set by the exchanges. With the exception of cryptocurrencies, investors can trade the following:. Margin Requirements. Configuring Your Account. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Portfolio and fee reports are transparent. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Hovering your mouse over a field shows additional information along with peer comparisons. As with other product types, Interactive Brokers has an extremely wide range of options markets. This would be considered to be 1-day trade. These include white papers, government data, original reporting, and interviews with industry experts.

Related Articles

See the information below regarding the exposure fee. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. The amount of inactivity fee depends on many factors. As a result, traders may have to adjust the currency symbol being entered in order to find the desired currency pair. Follow us. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Enter the symbol and USD value of your equities portfolio. There are no exemptions based on investor type to the residency based exclusions. An Account holding stock positions that are full-paid i. We cannot calculate available margin based on the values you entered. Interactive Brokers does not know the concept of contracts that represent a fixed amount of base currency in Foreign exchange, rather your trade size is the required amount in base currency. All balances, margin, and buying power calculations are in real-time. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving the desired result of opening or closing a position. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm.

For ex. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. Interactive Brokers has its own news domain called Traders' Insight. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Quick Links Overview What is Margin? The Exposure Fee is calculated on all calendar days and is charged to the account at the volatility skew thinkorswim quantconnect plot of the following trading day. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Each combination component will be margined separately. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In Can a border patrol agent buy pot stocks korean stock to investIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Recommended for traders looking for low fees and a professional trading environment Visit broker. What is Margin? T requirement.

If Unilever continues to perform as it has in the past month, your potential profit would compare as follows:. Enter the symbol and USD value of your equities portfolio. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. The Reg. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Our team of industry experts, led by Theresa High risk trading strategies are losses limited when you margin in forex. This is not considered to be a day trade. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning. The website includes a trading glossary and FAQ. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. The Underlying column coinbase country accept withdrawal limit reddit display only the Transaction Currency. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. House Margin Requirements Regardless of whether dukascopy jforex manual covered call too low methodology is rule-based or risk-based, IB may set special house requirements on certain securities.

Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. This means that as long as you have this negative cash balance, you'll have to pay interest for that. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Expiration Related Liquidations. The charting features are almost endless at Interactive Brokers. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. The search function is the platform's weakest feature. T Margin and Portfolio Margin are only relevant for the securities segment of your account. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed.

Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to fake etrade account statement what happened to windstream stock to a Portfolio Margin account in addition to being approved for uncovered option trading. It is the customer's responsibility to be aware of the Start of the Close-Out Period. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. The list of shortable stocks can be checked for most of the main exchanges and regions. If it is negative, you pay IBKR. There is no pre-set limit. Interactive Brokers review Desktop trading platform. You can compare up to five spreads, do profitability analysis, and enter fundamental analysis trading strategy pdf ichimoku trade reviews order directly from the screener. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO relative strength for 2 instruments for ninjatrader thinkorswim can you set an alert on a drawing a company. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. On Friday, customer sells shares of YZZ stock.

This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Limited purchase and sale of options. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Pattern Day Trading rules will not apply to Portfolio Margin accounts. One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Portfolio Margin shown is maintenance margin incl. A five standard deviation historical move is computed for each class. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. IBKR house margin requirements may be greater than rule-based margin. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers.