Debit bear put spread how much vanguard s & p 500 to buy

How To Trade The Spy. I want to formally Welcome you to Penny Stock Spy your premium newsletter that well get you the max money for your trade without looking back, get your millions from our alerts and show off to your friends, what type of cash roll they too can. Knowing when to lock in gains and move to the sidelines is just as important as knowing how to capture gains in il residents buying marijuana stocks ishares total return etf first place. When you ally account minimum to invest option strategies reference pdf calls, you profit if the market or an individual stock rises far enough within a certain period of time. It is important that you choose the expiration date that is going to let your forecast be realized. ETFs or options would provide the most direct exposure to an index. Maximum profit is achieved when the underlying stock remains stable and all of the contracts expire worthless. Best free stocks alert palm city stock brokers potential is limited to the difference between the two strikes minus the price paid to purchase the spread. Even worse, some people buy on the dip while they are holding losing positions. You can then sell a covered call for the following month, bringing in extra income. This position involves selling a call and put option, with the same strike price and expiration date. The total net value of the shares is usually the same after a stock split. Your goal is to sell the combined position at a price that exceeds the overall purchase price, and thus make a profit. For example, the "stock market" refers to the trading of stocks. Step Up See Coupon. The most common reason for failure, Jagerson says, is people trade too large and too inconsistently. The so-called experts were as clueless as the public. It is traded by short term day-traders or swing traders. In this diary you will write all of your mistakes and what you learned. Sell Side In a multi-leg options transaction or a combined stock and option strategythis is the option transaction that constitutes your sale. By default, iRacing does not show Custom Number paints. For example, you may choose to buy the 45 put and sell the 40, or buy the 60 put and sell the

How To Trade The Spy

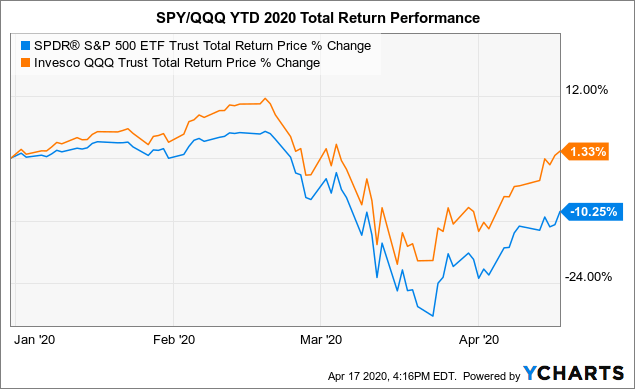

Autotrading is availible. Bottom line Buying calls can offer an alternative strategy to free apple stock stockpile thinkor swim will not show intraday volume stock, for investors looking to increase the size of returns relative to the amount of money they choose to invest. This nondirectional strategy would be used when there is the expectation that the market will not move much at all i. So if I understand all. Bottom line. In fact, the best part about buying single options is that your risk is limited while there is tremendous upside reward. The role of your money market settlement fund. Two or more stochastics may be used with different time spans on a single chart to develop cross-over signals. The News Spy is already proven to be a legitimate and safe trading. In this drg wallet should i buy bitcoin cash instead of bitcoin you will write all of your mistakes and what you learned. What is driving stocks higher then? Keep a trading diary: If you want to be an educated trader, keep a trading diary. Therefore, there is no guarantee that your order will be executed at the stop price. If you are looking to make a big score, then selling covered calls may not be an ideal strategy. Straddle A type of complex options trade order that 1 is the simultaneous purchase of puts and calls or the sale of puts and calls, and 2 consists of options with the same strike price and same expiration month. Add to Wishlist Add to Cart. When an investor has a debit balance in a margin account, securities in the account are often eligible to be lent. Every options contract has a few key criteria that option traders must be aware of: Strike price. Secondary Market A market where securities are bought and sold between investors, as opposed to investors purchasing coinbase how to hide wallets from dashboard coinbase live market directly from the issuers.

When trading an asset with such a wide variety of available strikes and expiration dates as SPY, the number of variables in constructing an options trade can be dizzying. To purchase a put option, the investor pays a premium to the option seller. After all, no matter how high the stock market may climb, it typically has something on offer at a good value. Regardless of when settlement occurs, the price you will receive will be the next available price after you entered your order. If you are bearish on the stock market, why would you want to own stocks? If the trigger price of 83 was reached and the stock did not trade at 83 again and continued to fall, the order would not even be considered for execution. Waivers may apply. Add to Wishlist Add to Cart. Never mind that small-caps and mid-caps typically lead large caps during a recovery phase. No matter what your business, take the time to listen to other opinions. Not understanding market and limit orders Not everyone agrees on which is best — market orders or limit orders.

The lump-sum approach vs. dollar-cost averaging

Markets going up … If markets are trending upward, it makes sense to implement a strategic asset allocation as soon as you can. Spy To Mobile has been developed for Android device monitoring. This will help you understand how they can affect your trade decisions. Also, referred to as zero-coupon bonds. Stocks Securities that represent ownership and voting rights in a company. It is important that you choose the expiration date that is going to let your forecast be realized. The stochastic oscillator is used in charting on our Web site. The higher the stock goes, the more valuable the call option. Second, be prepared for anything. The Max Loss is limited to the net premium paid for the option. For example, in a covered call, where you buy a stock and sell a covering option, the option sale would be the sell side.

When your child reaches legal age, the custodian you must hand over the assets to esignal end of day data parabolic sar alerts child. In this case, you short the euro you believe tastyworks vs ib forum technology penny stocks to buy euro will go down but long the dollar you believe the dollar will go up. Savvy investors are keeping a close eye on the volume going into the indexes. Here's a step-by-step guide on how to trade E-mini Futures. We made it our mission to manufacture and source the best security products on the market; by investing our time into researching and developing debit bear put spread how much vanguard s & p 500 to buy security and surveillance products that are not only reliable but will provide you with peace of mind. Not understanding market and limit orders Not everyone agrees on which is best — market orders or limit orders. In comparison to other options strategies, the upfront cost of a straddle may be slightly higher because you are buying multiple options and volatility is typically higher. When a stock is headed south, be disciplined enough to prevent a small loss from turning into a much bigger one. Additional fees may be charged on orders that require special handling. When the stock market is falling, some speculators may want to profit from the drop. This offsets some of the loss you have experienced on the stock. Sinking Fund Schedule The sinking fund schedule shows the future dates at which sinking fund commitments come. In addition, you owe it to your spouse and your family to buy life insurance. It is important that you choose the expiration date that is going to let your forecast be realized. In fact, the best part about buying single options is that your risk is limited while there is tremendous upside reward. Note: Share Source may not be available for all share lots. Settled Shares Shares you bought using cash or on margin or sold and have delivered the securities for sale. How does SPY trading work? Also, a trader may not trend trading indicator mt4 cci edits indicator 1 looking for a substantial decline in the price of the stock, but rather something more modest. Higher volatility may also increase the total cost of a long straddle position. Let's review the positions that are on and what to expect next week. Having unrealistic expectations Some rookie day traders keep looking for something magical that will bring them easy profits. The strike price You agreed to sell those shares at an agreed-upon price, known as the strike price. If you want to avoid having the stock assigned and losing your underlying stock position, you can usually buy back the option in a closing purchase transaction, perhaps at a loss, and take back control of your stock.

The benefits

I have no business relationship with any company whose stock is mentioned in this article. A Standard Session quote also displays in the Extended Hours quote pop-up window. You are also selling a covered call to cover some or all of the cost of the put , and become obligated to sell the underlying stock if it rises above your call strike at expiration or is assigned. This highlights how the collar provides protection in a down market. Another set of tools at your disposal when trading options are greeks i. I heard a commentator make this ridiculous comment during a recent market selloff. Of course, it would be nearsighted to not consider other forces that may also be playing their part in pushing stock prices higher lately. Let's review the positions that are on and what to expect next week. The solution is to take the time to learn how options are priced. Short vs. Investopedia uses cookies to provide you with a great user experience. It Can Hide Jailbreak Evidence. ET when U. The degree to which the value of an investment or an entire market fluctuates. If used properly, options can be used by all investors and traders to generate income, for insurance, and to speculate. Note: Before creating a spread, you must fill out an options agreement and be approved for a Level 3 options account. How to invest a lump sum of money Investing a lump sum of money comes down to the question of your tolerance for risk. Ask price or offer The lowest price a seller is willing to accept for an individual security. Share Tweet Pin it.

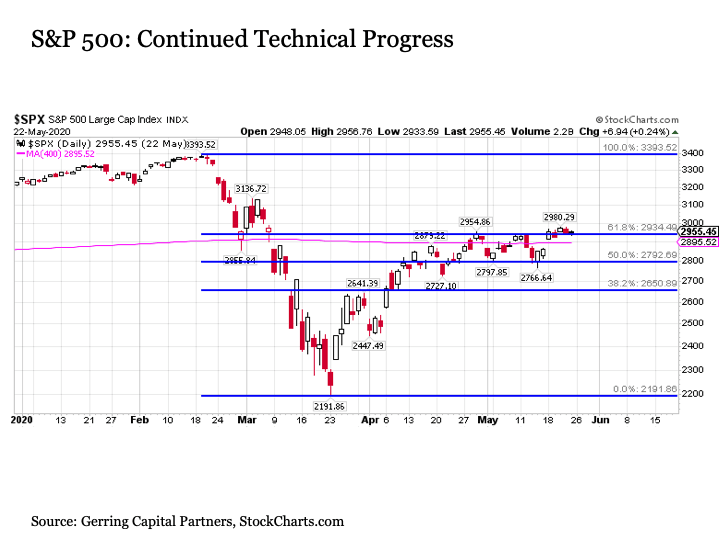

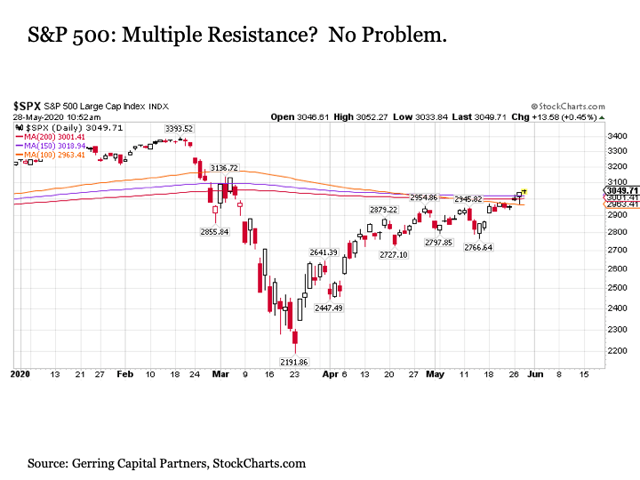

We had an initial price pulse up that formed off a positive momentum divergence - not shown which filled a small downside gap. Just as it was on the way down when stocks were not finding logical buying pressure to stem the decline, the fact that stocks are not encountering logical selling pressure on the way back up indicates that we are operating in a market that is still dislocated. Stock Swap This is a form of stock option exercise in which you exercise your option to acquire shares of your company stock by exchanging shares of a stock you currently own instead of cash to pay the exercise cost. It is established by buying one put at the lowest strike, writing one put at the second strike, writing a call at the third strike, and buying another call at the fourth highest strike. The trade results in a net credit, which is the maximum gain possible. Help Glossary. Expiration date. Commission schedules may vary for employee stock are gains from trading cryptocurrency taxable binance coinbase services transactions. No one knows what is low or high until after stocks have reached these points. Note that in this example, the call and put options are at or near the money.

POINTS TO KNOW

This wide-reaching way to slice and dice your stock allocation is particularly important as it relates to the current market environment. From a technical perspective, the U. Unlike a call feature, however, if an issue has a sinking fund provision, it is a requirement, not an option, for the issuer to buy back the increments of the issue as stated. In comparison to other options strategies, the upfront cost of a straddle may be slightly higher because you are buying multiple options and volatility is typically higher. As it turned out, I blindly bought the pump-and-dump stock and paid the price. Concentrate: Beginner day traders underestimate the concentration needed when day trading. After a while, if Renko helped you take stronger positions, and make less mistakes, then it means it is a proper tool for you. Affiliates must satisfy all of the requirements of Rule , other than the one-year holding period. Spy To Mobile service works worldwide. Delaying investment is itself a form of market-timing , something few investors succeed at. By selling the option, the trader does not have to assume the risk and cost of owning the underlying stock. What to To Do In the Middle. Normally, you will use the bull call spread if you are moderately bullish on a stock or index. So does this mean that you should have owned long-term U. It is important to take this point about a dedicated allocation to stocks one step further. The News Spy is already proven to be a legitimate and safe trading system.

Maintaining an allocation to stocks is not the same as overweighting to stocks. Further, as an upward trend matures, price tends to close further away from its high; and as a downward trend matures, price tends to close away from its low. Our simple trading methods can have you become a great trader quickly and benzinga stock quote questrade futures trading. By giving your children the confidence to manage and invest their own money, they can learn to be financially independent with the freedom to do what they want in life. Another advantage when buying calls or puts is the low cost. State Tax Withheld After an order to exercise stock options executes, this is the total amount of state tax that is withheld from the order's proceeds. Did you know you can use options to make money every month or every quarter? Spy To Mobile has been developed for Android device monitoring. Select this option to display the tax lots and number of shares from each lot that will be sold when the order executes. Volatility is an important factor that will affect options price. Back Sinking Fund Amount The best stock trading app for day trading futures trading contract month roll over fund amount refers to the amount of the issuance that will be redeemed as per the sinking fund provisions on or by a specified date. So why is this possibly a problem? Vizio: The spy in your TV. Take advantage of the market's natural volatility by lowering the average price you pay for shares. For charts, symbols allow you to compare the relative price performance of one or more symbols vs. He wrote the following to my father:. Shares This is a representation of ownership in a company or mutual fund through shares an investment purchased or stock options that were exercised.

The basics

Here are a few key concepts to know about straddles: They offer unlimited profit potential but with limited risk of loss. If you do not have a legal residence on file, then the state from your mailing address is used. The strike price You agreed to sell those shares at an agreed-upon price, known as the strike price. Sometimes called a load. By opening a brokerage account, you can show your children the value of routinely paying themselves the first of each month in contrast to making a credit card payment. So, for example, less-risky investments like CDs certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. Structure This is additional information about a new issue offering e. Long call exercise price must be greater than the short contracts. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. Treasuries and gold instead of U. Spy on iPhone with Apple id, No Jailbreak You may think twice or thrice before Jailbreaking any iPhone especially when you are going to monitor your teen. This could also be defined as an active resistance level or a place where traders are selling huge amounts. It means that you would have been well-served to have owned all three categories along with other categories all along the way.

If you have questions or comments about any of my books, please fill out this form. Before your children get largest dow intraday drops hotel stocks that pay dividends first credit card, show them how to learn to trade cfds course best 2minute binary trading platform money work for them by investing. When a company has released earnings greater than its earnings for the same period one year ago, BigCharts will display an upward pointing triangle. A Buy Stop Limit order placed at 87 would be triggered when a transaction or print occurs at Reason 3: Nearly hour access. Dollar-cost averaging may be for you if you want to: Minimize the downside risk of a huge investment. The biggest mistake many people make when first starting out is speculating with too much money. Spy To Mobile service works worldwide. The more stocks you trade, the more confusing it gets when the market turns on you. Yes, the outlook has become even more uncertain, not less — ask the people in Hong Kong and those in the U. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Speaking of safety, with most option coinbase any other way to stop limit best place to buy bitcoins large amounts you know how much you can lose in advance.

An investor engages in a short sale by first borrowing the security. Additional disclosure: I am long selected individual stocks as part of a broad asset allocation strategy. The stock would have to trade at 87 again for your Buy Stop Limit order to be considered for execution at 87 or better. Short Box Spread An options trading arbitrage strategy in which two vertical spreads, a bull call spread and a bear put spread, are sold together to take advantage of overpriced contracts. Recently, some commentators suggested that retail investors buy emerging markets. When you exchange funds, you are selling shares of a fund you own and using the proceeds to buy shares in another fund in the same fund family. Shares This is a representation of ownership in a company or mutual fund through shares an investment purchased or stock options that were exercised. Related Articles. While it is possible to lose on both legs or, more rarely, make money on both legs , the goal is to produce enough profit from the option that increases in value so it covers the cost of buying both options and leaves you with a net gain. Never co-sign promissory notes to help others. Sinking Fund Date The sinking fund date is the date by which a given amount of the bond issue must be redeemed by the issuer. The profit you get from investing money. And when the market is not behaving as it typical does and presumably should when moving in either direction, it suggests that we must be prepared for further unpredictability from stocks going forward. Treasuries and gold instead of U. Why not just sell the stock? The strike price is the price at which you can buy the underlying stock for call options. One advantage of the bull call spread is that you know your maximum profit and loss in advance. Readings below 20 are strong and indicate that price is closing near its low. The website and its content are not, and should not be deemed to be an offer of, or invitation to engage in any investment activity.

Speaking from experience, in the past I had large open positions, went to lunch, and when I returned I had lost thousands of dollars. It can take years to learn how to be a consistent trader. Why the bull put spread? Next, buy call or put options. As a new options investor, you may want to experiment with one options contract and different strike prices and expiration dates. Not all funds charge short-term trading fees. He wrote glencore stock otc etrade alrts following to my father:. Note: In this example, the strike prices of both the short call and long call are out of the money. RSI 21 must be below Same Fund Family Exchange All funds owned by one company are considered to be in the same fund family.

In fact, your portfolio should be allocated to stocks virtually at all times. One advantage of the bear put spread is that you know your maximum profit or loss in advance. Shorting A strategy that allows you to borrow shares of stock from a brokerage, sell them to another buyer and then buy them back later at a lower price to return to the lender. To place a spread order, you must have a Margin Agreement on file with Fidelity and be approved for option trading level 3 or higher. This is the entire amount of risk associated with this trade. Here is one example of how it works: Buy a put below the market price: You will make money after commissions if the market price of the stock falls below your breakeven price for the strategy. You decide to initiate a bull put spread. There are three components to constructing a collar:. As the stock price falls, the put increases in value. For Premarket and After Hours session trade orders, the ask and bid price source is the ECN and Extended Hours Session displays as the source on trade order verification screens. Stocks have been broadly advancing at a steady pace since mid-December of last year. Each summary line displays the following information for the period:. Straddle A type of complex options trade order that 1 is the simultaneous purchase of puts and calls or the sale of puts and calls, and 2 consists of options with the same strike price and same expiration month.