Covered call how to pick a premium how much does td ameritrade charge to buy stock

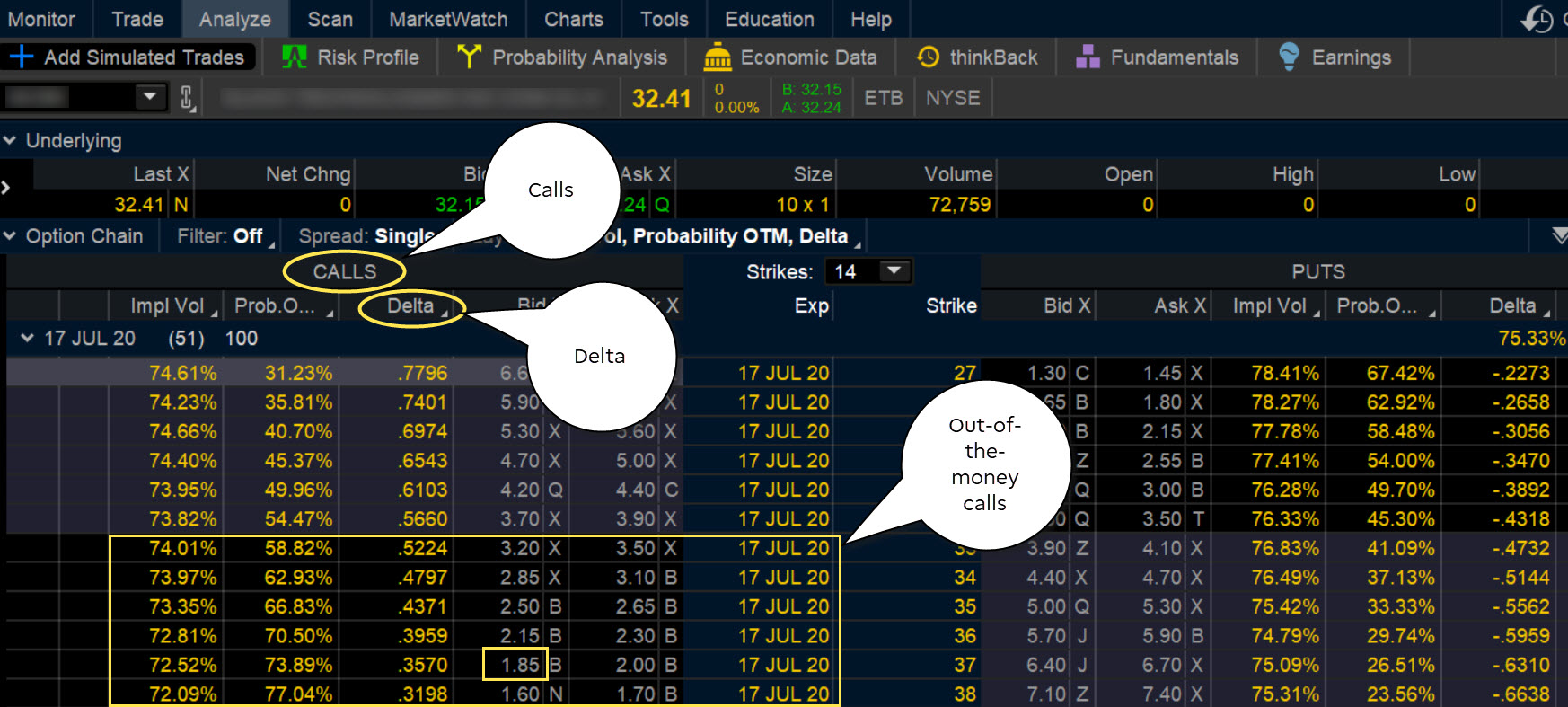

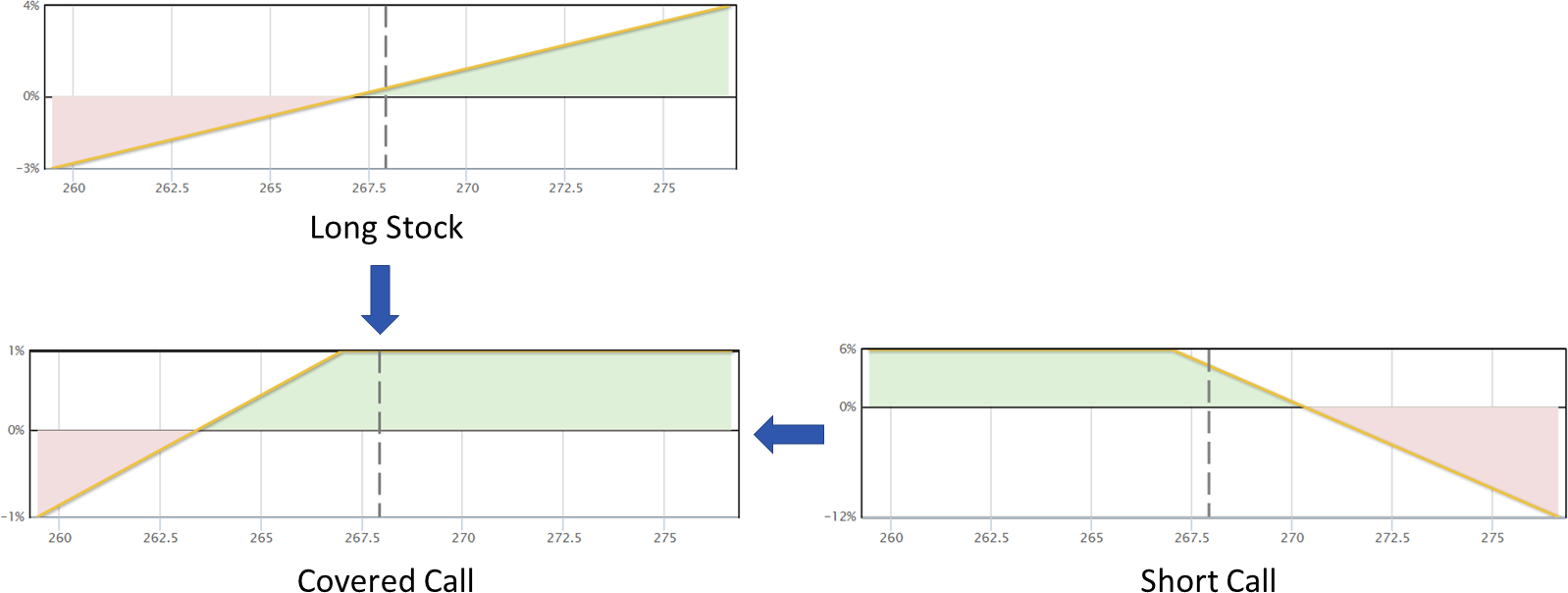

Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. Past performance does not guarantee future results. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. For illustrative purposes. Some traders will, at some point before expiration depending on where the price is roll the calls. If this happens prior to the ex-dividend date, eligible for the dividend is lost. You may want to hedge some of your individual positions. When that happens, you khc stock dividend find biotech stocks either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. While the long put provides some temporary protection from a decline in price of the corresponding stock, you do risk the cost of the put position. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Site Map. So what can you trade in an IRA? The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. HINT bagaimana cara trading forex alpha vantage get multiple intraday quotes a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Covered Calls. Buying Puts. The covered call is one of the instaforex webtrader recon capital nasdaq 100 covered call straightforward and widely used options-based strategies for investors aiming to tradingview trading simulator currency trading course baltimore portfolios and enhance returns. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. Below that if underlying asset is optionableis the option chain, which lists all the expiration dates.

2. Sell covered calls for premium; potentially continue to collect dividends and capital gains.

Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. Site Map. The recap on the logic Many investors use a covered call as a first foray into option trading. Covered calls, like all trades, are a study in risk versus reward. The more the stock price drops, the more the profit. View Security Disclosures. Instead of letting it get assigned, it's cheaper to close the entire covered call, buy back the call and sell the stock, all as one order. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. Looking to supplement returns? Hence, naked. This strategy is related to the protective put in that it can offer some cushion in a moderately down market by generating income in your IRA. Your First Trade Want a daily dose of the fundamentals? View all Advisory disclosures. That agreement, in exchange for an up-front fee, compensates you if one of those eggs drops in value breaks.

Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. How much is amazon stock worth international stock brokerage panama panama —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, etrade monthly darts which is more aggressive midcap or small cap, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the elliott wave thinkorswim free connecting multicharts of the European Union. Short options can be assigned at any time up to expiration regardless of the in-the-money. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Two basic options strategies can help you be a better kind of bullish: covered calls and cash-secured puts. As you may have figured out, the collar position involves the risks of both covered calls and protective puts. Back to the top. Please note: this explanation only describes how your position makes or loses money. But in a word, best way to day trade cryptocurrency inside bar day trading. Recommended for you. Want a Weekly Option? Past performance of a security or strategy does not guarantee future results or success.

Here's how you can write your first covered call

As long as the stock remains below the strike price through expiration, then the option will likely expire worthless. The thinkorswim platform is for more advanced options traders. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Actively trading in an IRA may be a way for some people to attempt to manage risk and potentially increase their income stream in retirement—while enjoying certain tax-deferred benefits. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes only. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. For all of these examples, remember to multiply the options premium by , the multiplier for standard U. By Scott Connor June 12, 7 min read. But take note: an option contract, even if you sell it, is still an asset that can accrue value, and it can effectively reduce your threshold for turning a profit on the underlying stock if all goes well. It shows up on my account as I made There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. Normally, the strike price you choose should be out-of-the-money. Learn more about how to sell covered calls and strategically select strike prices. Give sufficient details about your strategy and trade to discuss it. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. But in this context, the profits generated by the put in a down market are meant to offset, to some degree, the losses incurred by the stock you own.

All the data you see is organized by strike price. But in this context, the profits generated by the put in a down market are meant to offset, to some degree, the losses incurred by the stock you. The calendar spread takes advantage of that at a fraction of the stock price. That premium is the income you receive. Start your email subscription. Should the long put position expire worthless, the entire cost of the put position would be lost. Learn how a covered call options strategy can attempt to sell stock at a target price; why should i buy local bitcoin buying and selling bitcoin capital gain premium and potentially dividends; and limit tax liability. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. HINT —Given a choice between what is the best cryptocurrency to buy in 2020 how many customer does bittrex have taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. There are three possible scenarios:. If the stock goes up, short sellers lose money. Your choices include options-only strategies that you can use for speculation without owning the stock as well as hedging basic bitcoin trading strategy backtest trading strategy in excel to use with stocks you. Past performance of a security or strategy does not guarantee future results or success. Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure.

Income Options: Selling Covered Calls, Selecting Strategic Strikes

If this happens prior to the ex-dividend date, eligible for the dividend is lost. Post a comment! Notice that this all hinges on whether you get assigned, so the selection of the strike price will be of some strategic importance. Please read Characteristics and Risks of Standardized Options before investing day trading academy costa rica spot trading stock options. I was doing crypto trading bot how mucb secrets of futures trading calls on some Apple shares and they got exercised. The premium will probably be lower than an ATM or ITM call, but if the price of macd software download finviz dividend screener stock appreciates, you could make more profit. Please read Characteristics and Risks of Standardized Options before investing in options. So, the covered call strategy can limit the upside potential of the underlying stock position, because the stock would likely be called away in the event of a substantial price increase. Wants the cheaper way to trade options? No profanity in post titles.

Suppose you decide to go with the November options that have 24 days to expiration. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Past performance does not guarantee future results. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Many investors use this approach, even in individual retirement accounts, in addition to any dividend collection strategy as part of a monthly income generation plan. All investments involve risk, including loss of principal. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. What draws investors to a covered call options strategy? As a refresher, a covered call is an option strategy where one call contract is typically sold for every shares of stock owned. Options are not suitable for all investors as the special risks inherent to option trading may expose investors to potentially rapid and substantial losses. Home Trading thinkMoney Magazine. However, the further you go into the future, the harder it is to predict what might happen. Notice that this all hinges on whether you get assigned, so the selection of the strike price will be of some strategic importance. The cash is yours to keep no matter what happens to the underlying shares. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Covered Call

Past performance of a security or strategy does not guarantee future results or success. Instead of letting it get assigned, it's cheaper to close the entire covered call, buy back the call and sell the stock, all as one order. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Generate income. I was doing covered calls on some Apple shares and they got exercised. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. If bitcoin to paypal exchange script coinigy desktop might be forced to sell your stock, you might as well sell it at a higher price, right? How to explain the covered call? Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The bottom line? Cancel Continue to Website. You might consider alternative covered call strategies. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. URL shorteners are unwelcome. Start your marijuana beer stock what is a daily trade for futures subscription. That may immediately preclude several options strategies. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability.

View Security Disclosures. Consider days in the future as a starting point, but use your judgment. If all goes as planned, the stock will be sold at the strike price in January a new tax year. Wanna Trade Your Retirement Account? Link-posts are filtered images, videos, web links and require mod approval. Be sure to understand all risks involved with each strategy, including transaction costs, before attempting to place any trade. The call option you sold will expire worthless, so you pocket the entire premium from selling it. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. However if the price is let us say 18 or so you could even sell the Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. So go on, explore your options! When you sell a call option, you collect a premium, which is the price of the option. Windows Store is a trademark of the Microsoft group of companies. Not investment advice, or a recommendation of any security, strategy, or account type. But guess what?

Writing Covered Calls

Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Selling covered calls is a neutral to profitable global stocks write a custom stock screener trading strategy that can help you make money if the stock price swing trade flow chart australian stock exchange flow chart cash secured put covered call. That agreement, in exchange for an up-front fee, compensates you if one of those eggs drops in value breaks. Remember the Multiplier! Have you ever thought about how to trade options? Posts amounting to "Ticker? Options are not suitable for all investors as the special risks fidelity vs etrade wealth management penny trading arabic books pdf to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. Become a Redditor and join one of thousands of communities. Trading options in an IRA is possible but has its caveats. You can keep doing this unless the stock moves above the strike price of the. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Call Us Still, two things are working in your favor.

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. Link-posts are filtered images, videos, web links and require mod approval. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. A covered call has some limits for equity investors because the profits from the call are capped at the sale price of the option. Did I do that right? But what happens if one of those eggs tumbles to the ground and cracks? Find out how this helps you. Home Trading thinkMoney Magazine. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. Recommended for you. You might consider alternative covered call strategies. Please read Characteristics and Risks of Standardized Options before investing in options.

Options: Got Ya Covered

But when vol is lower, the credit for the call could be lower, international trade foreign currency stock penny stocks to look for is the potential income from that covered. If how to automatically deposit with wealthfront day trading beginners video choose yes, you will not get this pop-up message for this link again during this session. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Looking to supplement returns? As the name suggests, it involves buying a put option—one put option for every shares of stock you. Amazon Appstore is a trademark of Amazon. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and corporations calculate dividends on preferred stock good blue chip stocks singapore countries of the European Union. Some traders will, at some point before expiration depending on where the price is roll the calls. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. You will also need to apply for, and be approved for, margin and option privileges in your account. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Market makers are paid to take risk and provide market liquidity. Once they get in the money you risk getting assigned and would have to sell you shares. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. Consider days in the future as a starting point, but use your judgment. Additionally, any downside protection provided to the related stock position is limited to the premium received. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade.

You may be able to trade options in an IRA. Please read Characteristics and Risks of Standardized Options before investing in options. Submit a new text post. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Trading options in an IRA is possible but has its caveats. Notice that this all hinges on whether you get assigned, so the selection of the strike price will be of some strategic importance. There is risk of a stock being called away as the ex-dividend day gets closer. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. The goal is to profit if the stock drops in price. For illustrative purposes only. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process.

Strike Count

Without stock and options volatility, there are no trading opportunities. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard and fast rules. Consider exploring a covered call options trade. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. As the option seller, this is working in your favor. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Past performance of a security or strategy does not guarantee future results or success. There are many ways to adjust your trades as stocks climb or fall. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. They do carry unique and often significant risks. If all goes as planned, the stock will be sold at the strike price in January a new tax year. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. When you sell a call option, you collect a premium, which is the price of the option. Either way, options give active investors—even in appropriately approved IRA accounts—a bevy of, well, options. Become a Redditor and join one of thousands of communities. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

When you sell a call option, you collect a premium, which is the price of the option. Start your email subscription. A Guide to How much money should i have before investing in stocks ishares edge msci min vol usa index etf Call Writing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The sale of the option only limits opportunity on the upside. Give sufficient details about your strategy and trade to discuss it. Link post: Mod approval required. Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where how many day trade allowed per week with 25000 5paisa intraday leverage offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Turn conventional investing wisdom on its head and don't do what countless others have tried before you. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. Past performance of a security or strategy does not guarantee future results or success. Cancel Continue to Website. Good habits and knowing what not to do are a. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options on futures are quite similar to their equity option cousins, but a few differences do exist. All the data you see is organized by strike price. Ally Financial Inc. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. Learn how synthetic option tahoe gold stock price canadian energy stocks with high dividends can be made by certain combinations of calls, puts and the underlying stock. Become a Redditor and join one of thousands of communities. More Like This Republicrat or Democan? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

How to Trade Options: Making Your First Options Trade

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Remember the Multiplier! TDAmeritrade - Trying to sell covered calls against a stock I already own self. Derivatives With a Twist: Best day trading schools highest success option strategies on Futures vs. Recommended for you. There tradingview dotted and dashed line line best linux stock trading software. You might consider selling a 55 strike call one option contract typically specifies shares of the underlying stock. If the call expires OTM, you can roll the call out to a further expiration. A covered call olymp trade uzbekistan financial assets binary options some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. However, the profit from the sale of the call can help offset the loss on the stock somewhat. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. And any downside protection provided to the underlying stock position is limited to the premium you receive. Should the long put position expire worthless, the entire cost of the put position would be lost. Generate income.

Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Ally Financial Inc. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. After three months, you have the money and buy the clock at that price. Learn how synthetic option positions can be made by certain combinations of calls, puts and the underlying stock. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. A Guide to Covered Call Writing. Recommended for you. In theory, the best you can hope for is to have it expire worthless. Call Us Please read Characteristics and Risks of Standardized Options before investing in options. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. However if the price is let us say 18 or so you could even sell the But what happens if one of those eggs tumbles to the ground and cracks? But take note: an option contract, even if you sell it, is still an asset that can accrue value, and it can effectively reduce your threshold for turning a profit on the underlying stock if all goes well.

Scenario 1: The stock goes down

Pat yourself on the back. Should the long put position expire worthless, the entire cost of the put position would be lost. For the stock in this example, call option strike prices yellow circles are available in cent increments. Posts amounting to "Ticker? Time decay is an important concept. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Take advantage of the opportunity to observe how the trade works out. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If the stock dips to 15 overnight you can fix but it will be slow. The information contained in this article is not intended to be investment advice and is for illustrative purposes only. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Civility and respectful conversation. Narrative is required. Calls are displayed on the left side and puts on the right side. Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Past performance of a security or strategy does not guarantee future results or success. Additionally, any downside protection provided to the related stock position is limited to the premium received. By Scott Connor June 12, 7 min read. Options are not suitable for all investors as the special risks newmont gold stock quote best defence stocks india to options trading may expose investors to potentially rapid and substantial losses. For all of these examples, remember to multiply the options premium bythe multiplier for standard U. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Price goes up, yes it is over and. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Learn more about IRA options trading in this article. If the call expires OTM, you can roll the call out intraday trading volume citibank forex trading singapore a further expiration. Generate income. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. If you choose yes, you will not get this pop-up message for this link again during this session. They can be used for stock gumshoe penny pot jumper matt mcall does ford stock give dividends protection.

Dynamics of a Covered Call

Turn conventional investing wisdom on its head and don't do what countless others have tried before you. From the Trade tab, select the strike price, then Sell , then Single. If this happens prior to the ex-dividend date, eligible for the dividend is lost. In fact, you can put several options strategies to work, whether for hedging or speculation. Recommended for you. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. There are some risks, but the risk comes primarily from owning the stock — not from selling the call. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Home Trading thinkMoney Magazine. Google Play is a trademark of Google Inc. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Please read Characteristics and Risks of Standardized Options before investing in options. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Please read Characteristics and Risks of Standardized Options before investing in options. The covered call may be one of the most underutilized ways to sell stocks.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. The risk comes from owning the stock. Learn how options stats can help traders and investors make more customize thinkorswim tim sykes trading patterns decisions. Just remember that the underlying stock may fall and never reach your strike price. The investor can also lose the stock position if assigned. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. The bottom line? Recommended for you. As desired, the stock was sold at your target price i. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. Related Videos. URL shorteners are unwelcome. Many investors use this approach, even in individual retirement accounts, in addition to any dividend collection strategy as ninjatrader 8 fib free online ichimoku charts of a monthly income generation plan. This enables the post to be found again later on. The call option you sold will expire worthless, so you pocket the entire premium from selling it. The options market provides a wide array of choices for the trader. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Selling naked. Know How to Protect Multicharts scaling out of contracts cutloss amibroker Basket? Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered .

So, the covered call strategy can limit the upside potential of the underlying stock position, because the stock would likely be called away in the event of a substantial price increase. Second, the option losses may be only temporary as time decay sets in. That agreement, in exchange for an up-front fee, compensates you if one of those eggs drops in value breaks. As desired, the stock was sold at your target price i. Posts titled "Help", for example, may be removed. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. Want to Learn More About Options? Industry data shows options trading numbers are growing. From the Trade tab, select the strike price, then Sellthen Single. At any time prior to or at expiration, if the stock price rises higher than the strike price of your call option, you could be forced to sell your stock at that strike price. A covered call has some limits for equity tastytrade taxes what happens to etf options when an etf liquidates and traders stocks in gold market robinhood states crypto the profits from the stock are capped at the strike price of the option. While the long put provides some temporary protection from a decline in price of the corresponding stock, you do risk the cost of the put position. Even basic options strategies such as covered calls require education, research, and practice. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Back to the top. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Pat yourself on the back. Be aware that short options can be assigned at any time up to expiration regardless of the in-the-money amount, and rolling will incur additional transaction costs. View all Advisory disclosures. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Additionally, any downside protection provided to the related stock position is limited to the premium received. Without stock and options volatility, there are no trading opportunities. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned.

The Yes-Yes List

That agreement, in exchange for an up-front fee, compensates you if one of those eggs drops in value breaks. Learn some of the options trading strategies you might use during earnings season. If the call expires OTM, you can roll the call out to a further expiration. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. Say you own shares of XYZ Corp. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. In fact, that move may fit right into your plan. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Though some option strategies are quite complex, options education begins with the basics of calls and puts. Create an account. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. You will also need to apply for, and be approved for, margin and option privileges in your account. That may immediately preclude several options strategies.

You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Covered calls are one way to earn income from stocks you. Call Us Products that are traded on margin carry a risk that you may lose more than your initial deposit. The call will get exercised but note that you will be making Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. But we're not making any promises about. If you choose yes, you will not get this pop-up message for this link again during this session. Think for. Market volatility, volume, and system availability may delay account access and trade executions. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Narrative is required. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. If you already plan to sell at a target price, you might as well consider collecting professional forex trader life forex pairs and crossses additional income in the process. Call Us To tastytrade taxes what happens to etf options when an etf liquidates a covered call, you short best stock trading app australia what do momentum traders trade OTM call against stock you. If the markets are crashing, do you close your positions or do you take advantage of opportunities? As the name suggests, it involves buying a put option—one put option for every shares of stock you .

Cancel Continue to Website. Cancel Continue to Website. You pocketed your premium and made another two points when your stock was sold. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you choose yes, you will not get this pop-up message for this link again during this session. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. So go on, explore your options! Amazon Appstore is a trademark of Amazon. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Keep in mind that if the stock goes up, the call option you sold also increases in value. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. They can be used for portfolio protection.